Discussing 401(k) and IRA

When planning for retirement, two common options are a 401(k) and an IRA. Each has its own set of rules and benefits that individuals should consider when saving for their future.

Key Differences Between 401(k) and IRA

- A 401(k) is typically offered by an employer, while an IRA is opened by an individual.

- 401(k) contributions are made through payroll deductions, while IRA contributions are made by the individual.

- 401(k) contributions may be matched by the employer, providing additional funds for retirement savings.

- IRA contribution limits are generally lower than 401(k) limits.

Overview of How Each Retirement Account Works

A 401(k) is a retirement savings plan sponsored by an employer that allows employees to save and invest a portion of their paycheck before taxes are taken out. The funds in a 401(k) can grow tax-deferred until withdrawal during retirement.

On the other hand, an Individual Retirement Account (IRA) is a personal savings account that offers tax advantages for retirement savings. Contributions to a traditional IRA may be tax-deductible, and the funds can grow tax-deferred until withdrawal in retirement.

Comparison of Eligibility Criteria for 401(k) and IRA

- 401(k): Eligibility is often based on employment status and length of service with the employer. Some employers may offer immediate eligibility, while others may have a waiting period.

- IRA: Anyone with earned income can contribute to an IRA, regardless of employment status. However, there are income limits for deductible contributions to a traditional IRA.

Types of 401(k) and IRA

When it comes to retirement savings, there are various types of 401(k) and IRA accounts that individuals can choose from based on their financial goals and circumstances.

Types of 401(k) Plans

- Traditional 401(k): This type of 401(k) allows individuals to make pre-tax contributions, which can help lower their taxable income during their working years. The contributions and earnings are taxed when withdrawn during retirement.

- Roth 401(k): With a Roth 401(k), individuals contribute after-tax dollars, but qualified withdrawals in retirement are tax-free. This can be advantageous for those who anticipate being in a higher tax bracket in the future.

- Solo 401(k): Designed for self-employed individuals or small business owners without employees, this plan allows for higher contribution limits compared to traditional 401(k) plans.

Types of IRAs

- Traditional IRA: Contributions to a traditional IRA are often tax-deductible, reducing taxable income in the year of the contribution. Withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, but qualified distributions in retirement are tax-free. This can be advantageous for those expecting to be in a higher tax bracket during retirement.

- SEP IRA: Simplified Employee Pension (SEP) IRAs are designed for self-employed individuals or small business owners. Contributions are tax-deductible and can be made by both the employer and the employee.

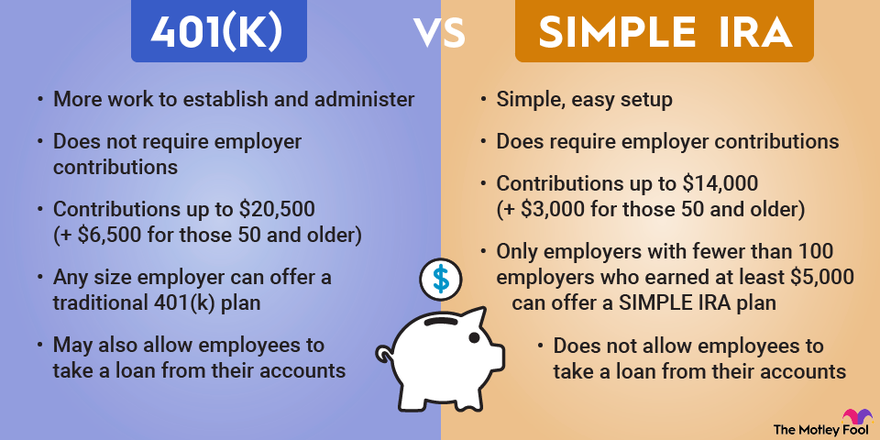

- SIMPLE IRA: Savings Incentive Match Plan for Employees (SIMPLE) IRAs are typically offered by small businesses. Employees can make contributions through salary deferrals, and employers are required to make contributions or match employee contributions.

Each type of account has its own unique features and benefits, so it’s important to consider factors such as tax implications, contribution limits, and eligibility requirements when choosing between a 401(k) and an IRA.

Contributions and Limits

401(k) plans have contribution limits set by the IRS, which can change annually. For 2021, the contribution limit for 401(k) plans is $19,500 for individuals under 50 years old. For individuals aged 50 and over, there is a catch-up contribution limit of an additional $6,500, making their total contribution limit $26,000.

Contribution Limits for Different Types of IRAs

- Traditional IRA: For 2021, the contribution limit for a Traditional IRA is $6,000 for individuals under 50 years old. Individuals aged 50 and over can make an additional catch-up contribution of $1,000, bringing their total limit to $7,000.

- Roth IRA: The contribution limit for a Roth IRA is the same as a Traditional IRA, with $6,000 for individuals under 50 years old and a catch-up contribution of $1,000 for those aged 50 and over.

Catch-up Contributions for 401(k) and IRA Accounts

Both 401(k) plans and IRAs allow for catch-up contributions for individuals aged 50 and over. This provision allows older individuals to save more for retirement and make up for any lost time in saving. For 401(k) plans, the catch-up contribution limit is $6,500, while for IRAs, it is $1,000. These additional contributions can help boost retirement savings significantly for those nearing retirement age.

Tax Implications

When it comes to retirement savings, understanding the tax implications of contributing to a 401(k) account versus an IRA is crucial. Let’s delve into the tax advantages of both options and how they impact your finances in the long run.

Tax Advantages of 401(k) Contributions

Contributing to a traditional 401(k) account allows you to reduce your taxable income in the year you make the contributions. This means that the money you contribute is deducted from your taxable income, lowering the amount of income tax you owe. Additionally, the earnings on your 401(k) investments grow tax-deferred until you start making withdrawals in retirement. This tax-deferred growth can help your retirement savings grow faster over time.

Tax Implications of IRA Contributions and Withdrawals

For traditional IRAs, contributions are also tax-deductible in the year you make them, similar to a traditional 401(k). However, when you withdraw money from a traditional IRA in retirement, those withdrawals are taxed as ordinary income. On the other hand, Roth IRAs are funded with after-tax dollars, meaning contributions are not tax-deductible. The advantage of a Roth IRA is that qualified withdrawals in retirement are tax-free, providing tax-free income in your golden years.

Comparison of Tax Treatment in Retirement

When it comes to withdrawals during retirement, 401(k) accounts and traditional IRAs are taxed as ordinary income. This means that the money you withdraw from these accounts in retirement is subject to income tax based on your tax bracket at that time. On the other hand, Roth IRAs offer tax-free withdrawals in retirement, as long as certain conditions are met. This can be advantageous for individuals who anticipate being in a higher tax bracket during retirement or want to minimize their tax liability in the future.