Annuities Overview

Annuities are financial products designed to provide a steady income stream for individuals during retirement. They work by allowing individuals to make a lump-sum payment or series of payments to an insurance company in exchange for regular payments over a period of time, either for a set number of years or for the rest of their life.

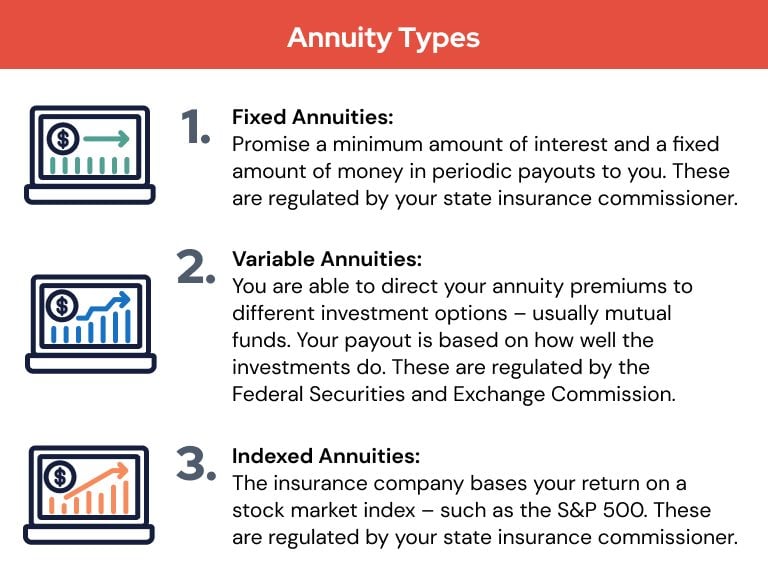

Types of Annuities

There are several types of annuities available in the market, including:

- Fixed Annuities: Guarantee a specific payment amount over a set period of time.

- Variable Annuities: Offer payments that fluctuate based on the performance of underlying investments.

- Immediate Annuities: Begin paying out immediately after a lump-sum payment.

- Deferred Annuities: Allow for payments to start at a later date, providing a way to grow funds tax-deferred.

Purpose of Annuities in Financial Planning

Annuities serve as a key tool in financial planning by providing a reliable income stream during retirement, helping individuals ensure they have enough money to cover their expenses after they stop working. They also offer tax advantages and the option for beneficiaries to receive payments in case of the annuitant’s death.

Benefits of Annuities

Annuities offer several advantages to individuals looking for a secure and reliable source of income during retirement or other stages of life. Let’s delve into the benefits of investing in annuities.

Tax Implications of Different Types of Annuities

When it comes to tax implications, different types of annuities have varying effects on your finances. Here’s a comparison:

- Immediate Annuities: With immediate annuities, you can receive a regular stream of income for a specified period or life. The earnings are taxable as ordinary income.

- Deferred Annuities: Deferred annuities allow you to grow your investment tax-deferred until withdrawals begin. This can provide a tax advantage as you may be in a lower tax bracket during retirement.

- Fixed Annuities: Fixed annuities offer a guaranteed interest rate, providing a stable income stream. The interest earned is tax-deferred until withdrawals are made.

- Variable Annuities: Variable annuities allow you to invest in sub-accounts similar to mutual funds. Earnings are tax-deferred until withdrawn, offering potential for growth.

Scenarios Where Annuities Can be Beneficial

- Supplementing Retirement Income: Annuities can serve as a reliable source of income during retirement, ensuring you have funds to cover expenses.

- Long-Term Financial Planning: By investing in annuities, you can create a financial plan that includes a guaranteed income stream for the future.

- Legacy Planning: Annuities can be used to leave a financial legacy for your loved ones, offering a way to pass on assets efficiently.

Risks Associated with Annuities

Investing in annuities comes with certain risks that investors need to be aware of in order to make informed decisions. These risks can impact the returns on your investment and affect your financial goals. Understanding these risks is crucial for managing your annuity effectively.

Interest Rate Risk

Interest rate risk is a significant factor to consider when investing in annuities. Fluctuations in interest rates can affect the returns on your annuity investment. If interest rates rise after you purchase a fixed-rate annuity, you may miss out on higher rates available in the market. On the other hand, if interest rates fall, the returns on your annuity may not keep pace with inflation, potentially diminishing the purchasing power of your funds.

Market Fluctuations

Market fluctuations can also impact the performance of variable annuities. These annuities are linked to investment options such as stocks and bonds, making them susceptible to market volatility. During bear markets or economic downturns, the value of your annuity may decrease, leading to lower returns or even losses. It’s essential to consider your risk tolerance and investment goals when choosing a variable annuity to mitigate the impact of market fluctuations on your investment.

Longevity Risk

Longevity risk is another factor to consider with annuities, especially when opting for lifetime income options. If you outlive your life expectancy, you may receive payments for a longer period than initially anticipated, potentially depleting the principal amount you invested. It’s crucial to assess your life expectancy and financial needs carefully to mitigate the risk of running out of funds in retirement.

Strategies to Mitigate Risks

To mitigate the risks associated with annuities, consider diversifying your investment portfolio. By spreading your investments across different asset classes, you can reduce the impact of market fluctuations on your overall financial health. Additionally, staying informed about economic trends, interest rate movements, and retirement planning strategies can help you make informed decisions when purchasing an annuity. Working with a financial advisor can also provide valuable insights and guidance in managing the risks associated with annuities effectively.

Annuity Features and Options

When it comes to annuities, there are various features and customization options available to investors. These options can help tailor the annuity to meet specific financial goals and risk tolerance levels.

Fixed, Variable, and Indexed Annuities

- Fixed Annuities: These annuities offer a guaranteed payout over a specific period. The interest rate is fixed and provides a stable income stream for the investor.

- Variable Annuities: With variable annuities, the returns are tied to the performance of underlying investments, such as mutual funds. This offers the potential for higher returns but also comes with greater risk.

- Indexed Annuities: Indexed annuities provide returns based on the performance of a specific market index, such as the S&P 500. These annuities offer a balance between fixed and variable options, providing the potential for growth with some downside protection.

Optional Riders for Annuities

- Guaranteed Minimum Income Benefit (GMIB): This rider ensures a minimum level of income, regardless of market performance, providing a safety net for investors.

- Long-Term Care Rider: This rider allows for funds to be used to cover long-term care expenses if needed, providing additional flexibility and protection.

- Death Benefit Rider: With this rider, beneficiaries are guaranteed a minimum payout upon the annuitant’s death, offering peace of mind to the investor and their loved ones.

Annuity Costs and Fees

When considering investing in an annuity, it is essential to understand the various costs and fees associated with owning one. These expenses can have a significant impact on the overall returns from the investment, so it’s crucial to be aware of them before making a decision.

Types of Fees in Annuities

- 1. Insurance Charges: These are fees charged by the insurance company to cover the costs of issuing and managing the annuity contract.

- 2. Investment Management Fees: Some annuities have underlying investments, such as mutual funds, which come with their own management fees.

- 3. Mortality and Expense Risk Fees: These fees cover the insurer’s costs for bearing the risk of providing lifetime income to the annuitant.

Comparing Fee Structures

- Variable Annuities: These typically have higher fees compared to fixed or indexed annuities due to the investment component involved.

- Fixed Annuities: Generally have lower fees since they offer a guaranteed interest rate for a specified period.

- Indexed Annuities: Fees can vary but are often lower than variable annuities as they track a market index without directly investing in it.

Impact of Fees on Returns

Fees can eat into the overall returns of an annuity, especially over the long term. Even seemingly small percentage differences in fees can result in significant reductions in the final payout.

Annuities in Retirement Planning

Annuities play a crucial role in retirement income planning by offering a reliable source of income during retirement years. Let’s explore how annuities can provide a guaranteed income stream and strategies for incorporating them into a comprehensive retirement plan.

Guaranteed Income Stream

Annuities offer the advantage of providing a guaranteed income stream for a specified period or even for the rest of your life. This can be particularly beneficial during retirement when you no longer have a regular paycheck. With annuities, you can ensure a steady income to cover your living expenses and maintain your lifestyle.

Incorporating Annuities into Retirement Plan

One strategy for incorporating annuities into a comprehensive retirement plan is to consider using a portion of your retirement savings to purchase an annuity that will provide you with a steady income stream. By diversifying your retirement income sources, including Social Security, pensions, and investments, annuities can serve as a reliable foundation for your financial security.

Tax-Deferred Growth

Annuities also offer tax-deferred growth, allowing your investment to grow without being taxed until you start receiving payments. This can be advantageous for retirement planning as it helps to maximize the growth potential of your savings over time.

Flexibility in Payout Options

Another benefit of annuities is the flexibility in payout options. You can choose between immediate annuities that start paying out right away or deferred annuities that allow your investment to grow before you start receiving payments. This flexibility enables you to tailor your annuity to meet your specific retirement income needs.

Legacy Planning

Incorporating annuities into your retirement plan can also be beneficial for legacy planning. By structuring your annuity payments to continue for the lifetime of your spouse or beneficiaries, you can ensure that your loved ones are financially secure even after you’re gone.