Overview of Behavioral Finance Insights

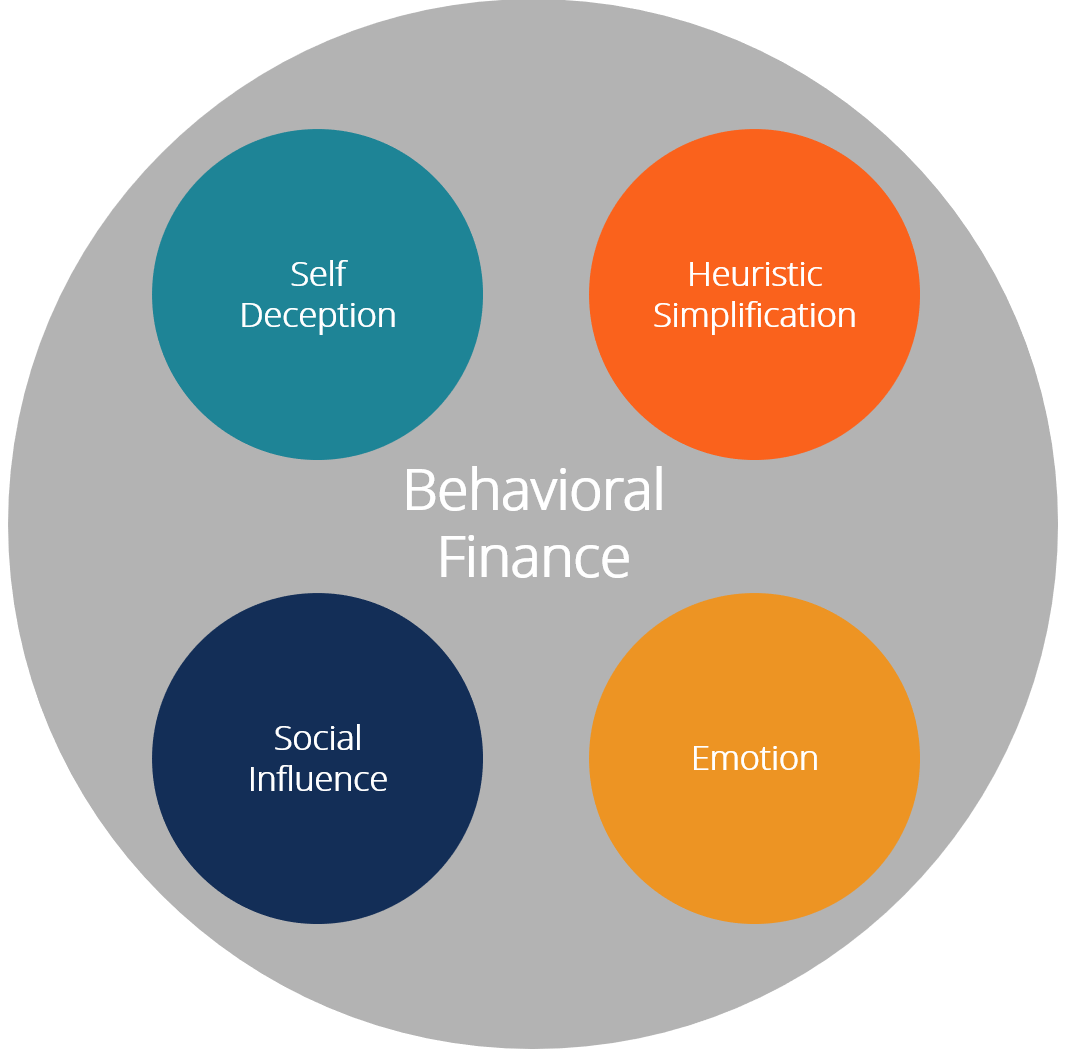

Behavioral finance is a field of study that combines psychology with economics to understand how human emotions and cognitive biases influence financial decisions. By recognizing these behavioral patterns, investors can better navigate the complexities of the financial markets.

Examples of Behavioral Biases in Financial Decision-Making

- Loss Aversion: Investors tend to feel the pain of losses more intensely than the pleasure of gains, leading to risk-averse behavior.

- Overconfidence: Individuals often overestimate their abilities, leading to excessive trading or taking on too much risk.

- Herding Behavior: People have a tendency to follow the crowd, even if it goes against their better judgment, causing market bubbles and crashes.

Importance of Understanding Behavioral Finance in Investment Strategies

- Improved Decision-Making: By being aware of their own biases, investors can make more rational and informed decisions.

- Risk Management: Understanding behavioral finance helps in managing emotional responses to market fluctuations and avoiding impulsive decisions.

- Enhanced Performance: Incorporating behavioral insights into investment strategies can lead to better long-term returns and portfolio diversification.

Common Behavioral Biases

Behavioral biases are systematic errors in judgment and decision-making that can affect how individuals perceive and act in financial markets. These biases are often influenced by emotions, cognitive shortcuts, and social factors. Let’s explore some common behavioral biases observed in financial markets.

Overconfidence Bias

Overconfidence bias refers to the tendency of individuals to overestimate their abilities, knowledge, or the accuracy of their predictions. In the context of investment decisions, this bias can lead investors to trade more frequently, take excessive risks, and have unrealistic expectations of returns. Overconfident investors may also ignore contradictory information or fail to adequately consider potential downsides, leading to poor decision-making and financial losses.

Loss Aversion Bias

Loss aversion bias is the tendency for individuals to strongly prefer avoiding losses over acquiring gains of equal value. This bias can have a significant impact on risk management in financial markets, as investors may be more willing to take on higher risks to avoid losses rather than to pursue potential gains. As a result, investors may hold onto losing investments for too long, miss out on profitable opportunities, or engage in irrational behavior to avoid realizing losses.

Behavioral Finance Theories

Behavioral finance theories play a crucial role in understanding how human behavior influences financial decision-making. These theories provide insights into the irrational aspects of investor behavior that traditional finance theories often overlook. One key theory in behavioral finance is Prospect Theory, proposed by Daniel Kahneman and Amos Tversky in 1979.

Prospect Theory

Prospect Theory suggests that individuals make decisions based on the potential value of losses and gains rather than the final outcome. This theory explains why investors tend to take more risks to avoid losses compared to the risks they would take to achieve gains of the same magnitude. According to Prospect Theory, individuals are more sensitive to losses than gains, leading to behaviors like loss aversion and risk-seeking in certain situations.

Comparison of Traditional and Behavioral Finance Theories

Traditional finance theories, such as the efficient market hypothesis and modern portfolio theory, assume that investors are rational and always act in their best interests. In contrast, behavioral finance theories acknowledge that investors often make decisions based on emotions, cognitive biases, and heuristics. While traditional theories focus on market efficiency and equilibrium, behavioral finance theories highlight the presence of market anomalies caused by human psychology.

Explanation of Market Anomalies

Behavioral finance theories provide explanations for various market anomalies that cannot be justified by traditional finance theories. These anomalies include phenomena like stock market bubbles, overreaction to news, and herding behavior among investors. By incorporating insights from psychology and behavioral economics, behavioral finance theories offer a more comprehensive understanding of how markets function and why certain patterns emerge.

Applications in Investment Management

Behavioral finance insights can be invaluable in portfolio construction, as they help investors understand and navigate the psychological factors that can influence decision-making. By incorporating behavioral finance principles, investors can better manage their emotions, avoid common biases, and make more rational investment choices.

Applying Behavioral Finance in Portfolio Construction

- Utilize diversification to mitigate the impact of overconfidence bias.

- Set clear investment goals and stick to a well-defined strategy to counteract the effects of loss aversion.

- Regularly review and rebalance your portfolio to prevent the influence of anchoring bias.

Strategies to Mitigate Behavioral Biases on Investment Performance

- Implement rules-based investing to reduce the impact of emotional decision-making.

- Seek out contrarian viewpoints to challenge confirmation bias.

- Work with a financial advisor or utilize automated investing tools to help remove personal biases from the decision-making process.

Financial Advisors and Behavioral Finance Principles

- Engage clients in discussions about their financial goals and risk tolerance to address framing effects.

- Educate clients about common biases and how they can impact investment decisions.

- Encourage clients to focus on long-term objectives and avoid making impulsive decisions based on short-term market fluctuations.