Introduction to Investment Strategies

:max_bytes(150000):strip_icc()/top-investing-strategies-2466844-FINAL-33a6c4fecfc14360837d5daa36c079a7.png)

Investment strategies play a crucial role in financial planning by guiding individuals on how to allocate their resources to achieve their financial goals. These strategies involve making decisions on where to invest money, how much to invest, and for how long.

The Importance of Having a Well-Thought-Out Investment Strategy

A well-thought-out investment strategy is essential for individuals looking to grow their wealth and secure their financial future. It helps in maximizing returns while minimizing risks, ensuring a balanced portfolio that aligns with the investor’s risk tolerance and financial objectives.

The Role of Investment Strategies in Achieving Financial Goals

Investment strategies serve as a roadmap for individuals to reach their financial goals, whether it’s saving for retirement, buying a home, or funding a child’s education. By following a strategic approach to investing, individuals can make informed decisions that support their long-term financial aspirations.

Types of Investment Strategies

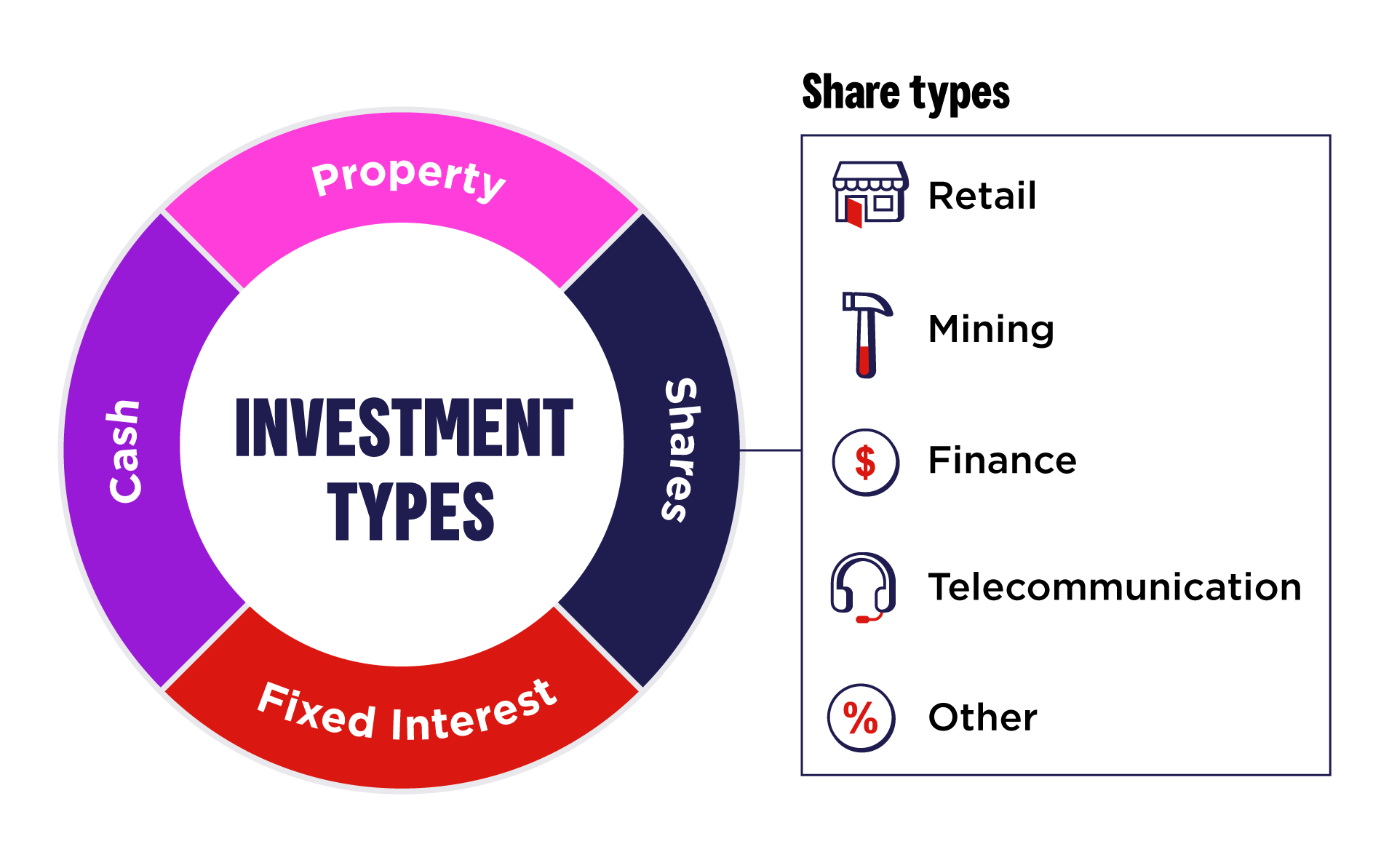

Investors have a variety of investment strategies to choose from based on their financial goals, risk tolerance, and time horizon. Understanding the different types of investment strategies is crucial for making informed decisions when building a diversified portfolio.

Value Investing

Value investing involves selecting undervalued stocks that are trading below their intrinsic value. This strategy focuses on buying assets at a discount and holding them for the long term, anticipating their price to eventually reflect their true worth.

Growth Investing

Growth investing, on the other hand, targets companies with high growth potential. Investors seek out stocks of companies expected to experience above-average growth in revenue and earnings. This strategy typically involves higher risk but also has the potential for significant returns.

Income Investing

Income investing focuses on generating a steady stream of income through investments such as dividend-paying stocks, bonds, and real estate investment trusts (REITs). This strategy is popular among retirees or investors seeking regular cash flow.

Active vs. Passive Investing

Active investment strategies involve frequent buying and selling of securities in an attempt to outperform the market. This approach requires active management and research, often resulting in higher fees. Passive investing, on the other hand, aims to replicate the performance of a specific market index. This strategy typically involves lower fees and less frequent trading.

Risk-Return Profiles

Each investment strategy comes with its own risk-return profile. Generally, strategies with higher potential returns, such as growth investing, also come with higher risks. Conversely, strategies focused on capital preservation, like value investing, tend to offer lower returns but come with reduced risk. It is essential for investors to assess their risk tolerance and investment goals when selecting a strategy that aligns with their financial objectives.

Factors to Consider When Choosing an Investment Strategy

When selecting an investment strategy, there are several key factors that investors need to consider to ensure that their investment aligns with their financial goals and risk tolerance.

Investor’s Risk Tolerance and Time Horizon

Understanding your risk tolerance and time horizon is crucial when choosing an investment strategy. Risk tolerance refers to how comfortable you are with the possibility of losing money on your investments. Investors with a high risk tolerance may opt for aggressive strategies with the potential for higher returns but also higher volatility. On the other hand, conservative investors may prefer strategies with lower risk and lower potential returns. Time horizon, on the other hand, refers to the length of time you plan to hold onto your investments. Longer time horizons may allow investors to take on more risk as they have more time to weather market fluctuations.

Impact of Market Conditions

Market conditions play a significant role in determining the most suitable investment strategy. During periods of economic growth and stability, investors may choose more growth-oriented strategies to capitalize on market upswings. Conversely, during economic downturns or market volatility, investors may lean towards defensive strategies to protect their capital. Being aware of prevailing market conditions can help investors adjust their strategies accordingly.

Financial Goals and Objectives

Financial goals and objectives are fundamental in guiding the selection of an investment strategy. Investors must clearly define what they aim to achieve through their investments, whether it’s wealth accumulation, retirement planning, or funding education. These goals will determine the appropriate level of risk to take on, the expected returns, and the investment timeline. By aligning investment strategies with financial objectives, investors can work towards achieving their desired outcomes.

Diversification in Investment Strategies

Diversification is a crucial concept in investment strategies that involves spreading your investment across different assets to reduce risk. By diversifying your portfolio, you can minimize the impact of a single investment performing poorly.

When it comes to reducing risk in investment strategies, diversification plays a key role. Here are some examples of how diversification can help mitigate risk:

Diversifying Across Asset Classes

- Diversifying across different asset classes such as stocks, bonds, and real estate can help you balance out the risk associated with each asset class. For example, if the stock market experiences a downturn, your bond investments may perform better, offsetting potential losses.

- Investing in a mix of high-risk and low-risk assets can help you achieve a balance between potential returns and risk tolerance.

Diversifying Across Industries

- Investing in companies from different industries can help protect your portfolio from sector-specific risks. For instance, if one industry is facing challenges, investments in other industries can help cushion the impact on your overall portfolio.

- By diversifying across industries, you can benefit from the growth of various sectors and reduce the reliance on the performance of a single industry.

Diversifying Across Geographies

- Investing in assets from different geographical regions can help you reduce the impact of country-specific risks. Economic, political, or market events in one country may not affect investments in another country, providing a level of insulation for your portfolio.

- Diversifying across geographies can also expose you to different market conditions and opportunities for growth, enhancing the overall resilience of your investment portfolio.