Types of Budgeting Apps

Budgeting apps come in various types to cater to different user preferences and needs. These can be broadly categorized as manual budgeting apps and automated budgeting apps, each with its unique features and benefits.

Manual Budgeting Apps

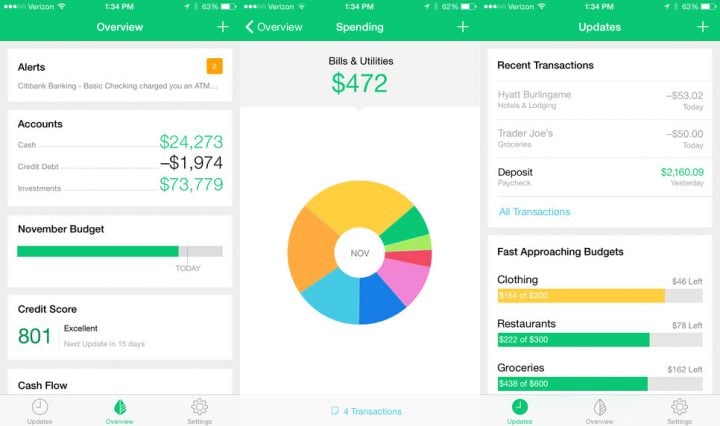

Manual budgeting apps require users to input their expenses, income, and financial goals manually. These apps often provide tools for tracking spending, setting budgets, and generating reports. While they may require more effort from the user, manual budgeting apps offer a high level of customization and control over financial data. Examples of popular manual budgeting apps include Mint, YNAB (You Need a Budget), and EveryDollar.

Automated Budgeting Apps

Automated budgeting apps, on the other hand, sync with users’ bank accounts and credit cards to track transactions automatically. These apps categorize expenses, analyze spending patterns, and provide real-time updates on financial status. While they offer convenience and time-saving features, automated budgeting apps may lack the level of personalization that manual apps provide. Examples of popular automated budgeting apps include Personal Capital, PocketGuard, and Truebill.

Comparison

In comparing manual and automated budgeting apps, it ultimately comes down to personal preference and financial management style. Manual apps are ideal for users who prefer a hands-on approach to budgeting and want full control over their financial data. On the other hand, automated apps suit users who value convenience and real-time tracking of their finances without the need for manual input. Both types of apps have their strengths and weaknesses, so choosing the right one depends on individual needs and preferences.

Benefits of Using Budgeting Apps

Budgeting apps offer numerous advantages when it comes to managing personal finances effectively. These apps can help individuals track expenses, set financial goals, and ultimately improve their financial health.

Expense Tracking Made Easy

One of the key benefits of using budgeting apps is the ease with which users can track their expenses. By inputting transactions and categorizing spending, individuals can get a clear picture of where their money is going each month.

Setting Financial Goals

Budgeting apps also allow users to set specific financial goals, whether it’s saving for a vacation, paying off debt, or building an emergency fund. These apps can help individuals stay motivated and on track towards achieving their financial objectives.

Real-Life Scenarios

For example, Sarah used a budgeting app to track her expenses and was able to identify areas where she was overspending. By making adjustments to her budget, she was able to save enough money to purchase a new car within a year.

Similarly, John used a budgeting app to set a goal of paying off his student loans in five years. With the help of the app’s tracking feature, he was able to stay disciplined and make extra payments towards his loans, ultimately becoming debt-free ahead of schedule.

Key Features to Look for in Budgeting Apps

When choosing a budgeting app, it is crucial to consider key features that will help you effectively manage your finances. These features can make a significant difference in how well the app suits your needs and helps you achieve your financial goals.

Importance of Security and Data Privacy

One of the most critical aspects to consider when selecting a budgeting app is the level of security and data privacy it offers. Your financial information is sensitive and should be protected from unauthorized access or breaches. Look for budgeting apps that use encryption technology to secure your data and have robust privacy policies in place.

Integration with Banking and Financial Institutions

Another essential feature to look for is the app’s ability to integrate with your bank accounts and financial institutions. This integration allows the app to track your income, expenses, and transactions accurately, providing you with real-time updates on your financial status. Make sure the budgeting app you choose supports connections to a wide range of financial institutions for comprehensive financial tracking.

Tips for Effective Budgeting with Apps

Utilizing budgeting apps can significantly enhance your financial management skills and help you achieve your financial goals. Here are some tips to make the most out of budgeting apps:

Set Realistic Budget Goals

Before using a budgeting app, it is crucial to establish realistic financial goals. Whether you aim to save for a vacation, pay off debt, or increase your emergency fund, setting achievable targets will keep you motivated and focused.

Categorize Your Expenses

Properly categorizing your expenses in the budgeting app allows you to identify areas where you can cut back or adjust your spending. Create specific categories such as groceries, utilities, entertainment, and track your expenses accordingly.

Analyze Financial Trends Regularly

Make it a habit to review your financial trends and reports generated by the budgeting app regularly. This practice will help you identify patterns, understand your spending habits, and make informed decisions to improve your financial situation.

Stay Consistent and Motivated

Consistency is key when it comes to effective budgeting. Set aside time each week to update your budget, track expenses, and monitor your progress. Find ways to stay motivated, such as rewarding yourself for reaching milestones or visualizing the financial benefits of sticking to your budget.