Types of Budgeting Techniques

Traditional budgeting methods have been widely used by businesses for years. These methods involve creating budgets based on historical data and making adjustments for the upcoming period. While they provide a familiar framework, they may not always be the most effective in today’s dynamic business environment.

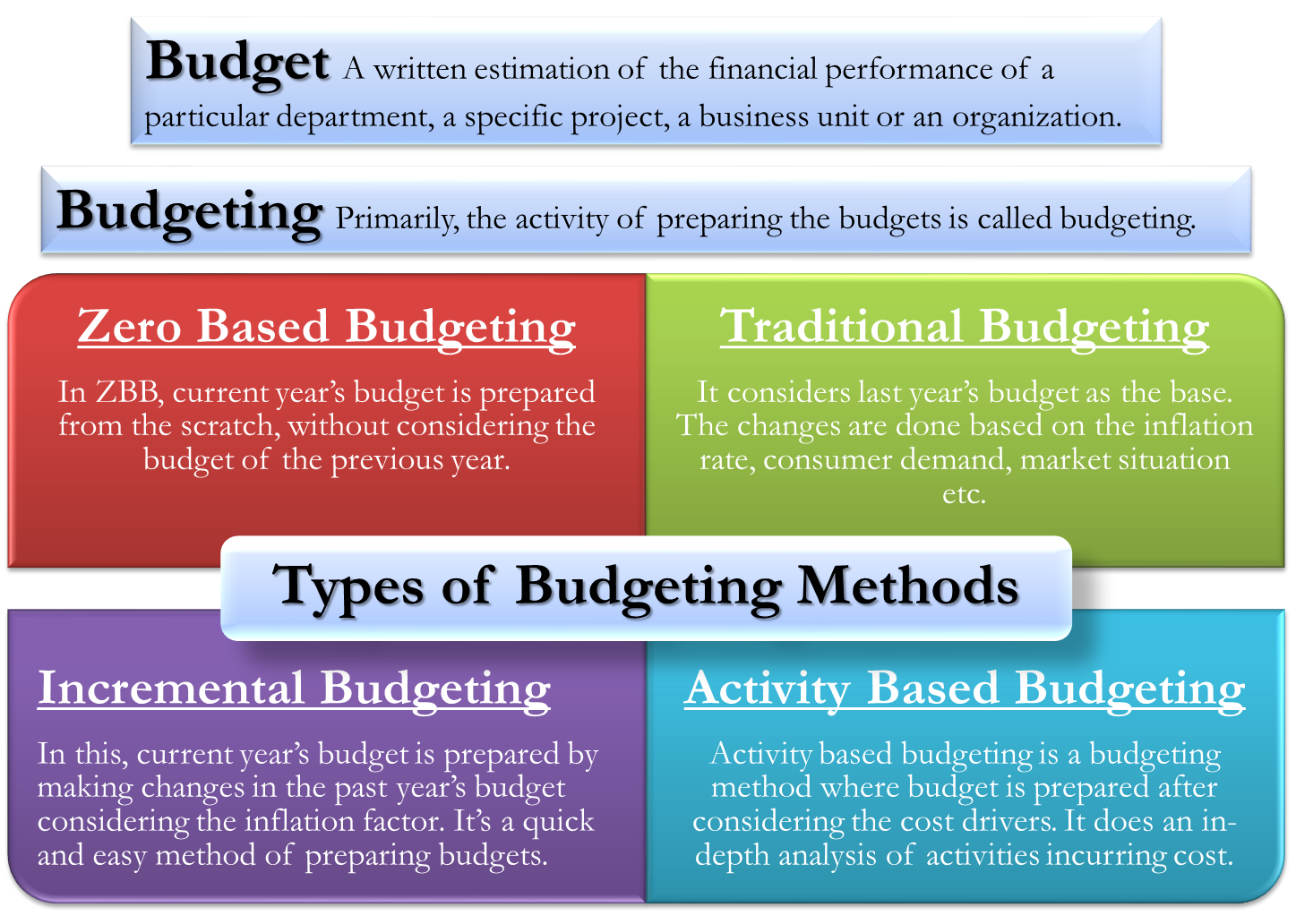

Zero-Based Budgeting

Zero-based budgeting is a method where all expenses must be justified for each new period, starting from zero. This approach forces managers to evaluate each expense and prioritize where resources should be allocated. By requiring a thorough review of all expenses, zero-based budgeting can lead to more efficient resource allocation and cost savings.

Activity-Based Budgeting

Activity-based budgeting focuses on the costs associated with specific activities or processes within an organization. Instead of allocating resources based on historical data, this method identifies activities that drive costs and allocates resources accordingly. By aligning resources with activities that create value, businesses can optimize their budgeting process and improve overall performance.

Rolling Budgets

Rolling budgets are continuously updated budgets that extend over a set period, such as 12 months. Unlike traditional static budgets, rolling budgets allow for adjustments and revisions based on changing circumstances. This flexibility enables businesses to adapt to market fluctuations and make more informed decisions throughout the year.

Personal Budgeting Strategies

Creating a personal budget is essential for managing finances effectively. It helps individuals track their expenses, prioritize savings, and achieve financial goals.

The Envelope System

The envelope system is a budgeting technique where you allocate a certain amount of cash to different categories (such as groceries, entertainment, or transportation) and keep the cash in separate envelopes. Once the cash in an envelope is gone, you can no longer spend on that category for the month. This method helps to control spending and avoid overspending in any category.

The 50/30/20 Rule for Budgeting

The 50/30/20 rule is a popular budgeting method that suggests dividing your after-tax income as follows: 50% for needs, 30% for wants, and 20% for savings or debt repayment. This rule provides a simple guideline for allocating your income effectively and ensuring that you prioritize essential expenses and savings goals.

Manual vs. Automated Budget Tracking

Manual budget tracking involves recording expenses and income by hand, while automated budget tracking uses apps or software to track financial transactions automatically. Manual tracking offers a hands-on approach that can increase awareness of spending habits, while automated tracking provides convenience and real-time insights into your financial situation. Both methods have their benefits, and the choice depends on personal preference and financial goals.

Advanced Budgeting Methods

When it comes to advanced budgeting methods, there are several strategies that can take your financial planning to the next level. These methods go beyond traditional budgeting techniques and offer a more dynamic approach to managing your finances.

Beyond Budgeting Principles

Beyond budgeting principles focus on flexibility and adaptability in financial planning. Instead of rigid annual budgets, this approach emphasizes continuous monitoring and adjustments based on real-time data and changing circumstances.

Priority-Based Budgeting

Priority-based budgeting involves allocating funds based on the most important financial goals and objectives. By prioritizing spending in this way, individuals can ensure that essential expenses are covered before allocating funds to less critical areas.

Continuous Budgeting

Continuous budgeting is a dynamic budgeting approach that involves regularly updating and revising financial plans. This method allows for ongoing adjustments to budget allocations based on changing financial circumstances and goals.

Rolling Forecasts in Budgeting

Rolling forecasts in budgeting involve updating financial projections on a rolling basis, typically on a monthly or quarterly schedule. This approach enables organizations to adapt to changing market conditions and make more accurate financial decisions based on up-to-date information.

Technology and Budgeting

Technology plays a crucial role in modern budgeting, offering various tools and solutions to streamline the process and improve financial management. From budgeting software to artificial intelligence, there are numerous ways technology can enhance budgeting techniques.

Budgeting Software and Streamlining

Budgeting software allows users to create, track, and manage their budgets more efficiently compared to traditional manual methods. These tools often provide automated features for categorizing expenses, setting financial goals, and generating reports for analysis.

- Quicken: A popular budgeting software that offers features such as expense tracking, bill management, and investment monitoring.

- You Need a Budget (YNAB): Focuses on zero-based budgeting, where every dollar is allocated a specific purpose, helping users prioritize spending and savings goals.

- Mint: Helps users track their spending, set budget limits, and receive alerts for unusual transactions, providing a comprehensive overview of their financial health.

Artificial Intelligence in Budgeting

Artificial intelligence (AI) is increasingly being integrated into budgeting tools to provide personalized insights and recommendations based on spending patterns and financial goals. AI algorithms can analyze data quickly and accurately, helping users make informed decisions about their finances.

AI can identify trends and patterns in spending behavior, suggesting areas where users can cut costs or save more effectively.

Using Spreadsheets for Budgeting

While budgeting software offers advanced features, many still prefer using spreadsheets for budgeting and financial analysis due to their flexibility and customization options. Spreadsheets allow users to create tailored budget templates, perform complex calculations, and visualize data in a format that suits their needs.