Importance of Emergency Fund Planning

Having an emergency fund is crucial for financial stability as it provides a safety net for unexpected expenses that may arise. It allows individuals to cover unforeseen costs without having to resort to high-interest loans or draining their savings meant for other goals.

Examples of Unexpected Expenses

- Medical emergencies that require immediate attention and costly treatments.

- Car repairs or home maintenance issues that cannot be postponed.

- Job loss or reduction in income that affects the ability to cover regular expenses.

Peace of Mind During Uncertain Times

An emergency fund can provide peace of mind during uncertain times by offering financial security and stability. Knowing that there is a fund set aside specifically for unexpected situations can alleviate stress and anxiety related to financial hardships. It allows individuals to focus on finding solutions rather than worrying about how to cover emergency expenses.

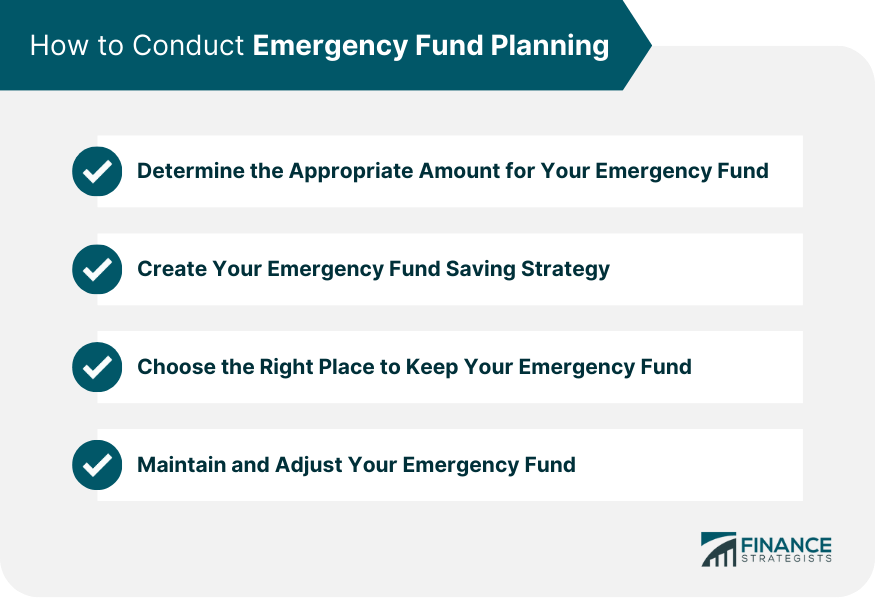

Setting Up an Emergency Fund

Setting up an emergency fund is a crucial step towards financial security and stability. Financial experts typically recommend having an emergency fund that can cover three to six months’ worth of living expenses. This amount should be enough to help you weather unexpected financial setbacks without having to rely on credit cards or loans.

Recommended Size of an Emergency Fund

It is generally advised to have an emergency fund that can cover at least three to six months of your living expenses. This includes essential costs such as rent or mortgage payments, utilities, groceries, insurance premiums, and other necessary expenses.

Calculating the ideal amount for your emergency fund:

- Start by adding up all your essential monthly expenses.

- Multiply this total by the number of months you want to cover (usually three to six months).

- Consider any additional factors such as dependents, health issues, or job stability that may require a larger emergency fund.

Strategies for Building Up Your Emergency Fund

Building an emergency fund takes time and discipline, but it is a worthwhile endeavor for your financial well-being. Here are some strategies to help you gradually increase the size of your emergency fund:

Gradually building up your emergency fund:

- Set a monthly savings goal and automate transfers to your emergency fund.

- Cut back on non-essential expenses to free up more money for savings.

- Consider earning extra income through side gigs or freelance work to boost your savings rate.

- Redirect windfalls such as tax refunds or bonuses directly into your emergency fund.

Types of Investments for Emergency Funds

When it comes to setting up an emergency fund, choosing the right type of investment is crucial to ensure that your funds are easily accessible in times of need. Let’s explore the different types of investments suitable for emergency funds.

Low-Risk Investment Options

Low-risk investment options are ideal for emergency funds as they provide stability and liquidity. Some common low-risk investments include:

- Savings Account: Offers easy access to funds with minimal risk, but typically lower interest rates.

- Money Market Account: Combines the convenience of a savings account with slightly higher interest rates, while still maintaining low risk.

It is important to consider the trade-off between liquidity and potential returns when choosing between a savings account and a money market account for your emergency fund.

Liquid Assets for Emergency Funds

Liquid assets are assets that can be quickly converted into cash without significant loss of value. Examples of liquid assets that can be part of an emergency fund include:

- Cash: Physical cash on hand or in a checking account for immediate access.

- Short-term Treasury Bonds: Easily convertible to cash and relatively low-risk investments.

- Certificates of Deposit (CDs): Provide slightly higher interest rates than savings accounts while maintaining liquidity with early withdrawal penalties.

Having a mix of liquid assets in your emergency fund ensures that you can access funds quickly in case of unexpected expenses or financial emergencies.

Managing and Accessing an Emergency Fund

Having an emergency fund is crucial, but knowing how to manage and access it effectively is equally important. Here are some best practices to keep in mind:

Using Funds Wisely

- Only dip into your emergency savings for true emergencies, such as unexpected medical expenses, car repairs, or job loss.

- Avoid using the fund for non-essential purchases or expenses that can be planned for in advance.

- Set clear criteria for what constitutes an emergency to prevent frivolous spending.

Replenishing the Fund

- Once you’ve used funds from your emergency savings, make it a priority to replenish the amount as soon as possible.

- Allocate a portion of your monthly budget specifically towards rebuilding your emergency fund.

- Consider cutting back on non-essential expenses temporarily to accelerate the replenishment process.