Importance of Investment Diversification

Investment diversification is a crucial strategy for building a well-rounded portfolio. By spreading your investments across different asset classes, industries, and geographical regions, you can reduce the overall risk in your portfolio.

Diversification helps mitigate risk in investments by ensuring that a single economic event or market downturn does not have a catastrophic impact on your entire portfolio. For example, if you only invest in one sector and that sector experiences a downturn, your entire investment could suffer. However, by diversifying across multiple sectors, the impact of a downturn in one sector can be offset by gains in others.

Furthermore, diversification can enhance long-term returns for investors. While it may limit the potential for huge gains in any single investment, it also reduces the likelihood of significant losses. Over time, a diversified portfolio can provide more stable returns and help you achieve your financial goals with less volatility.

Strategies for Investment Diversification

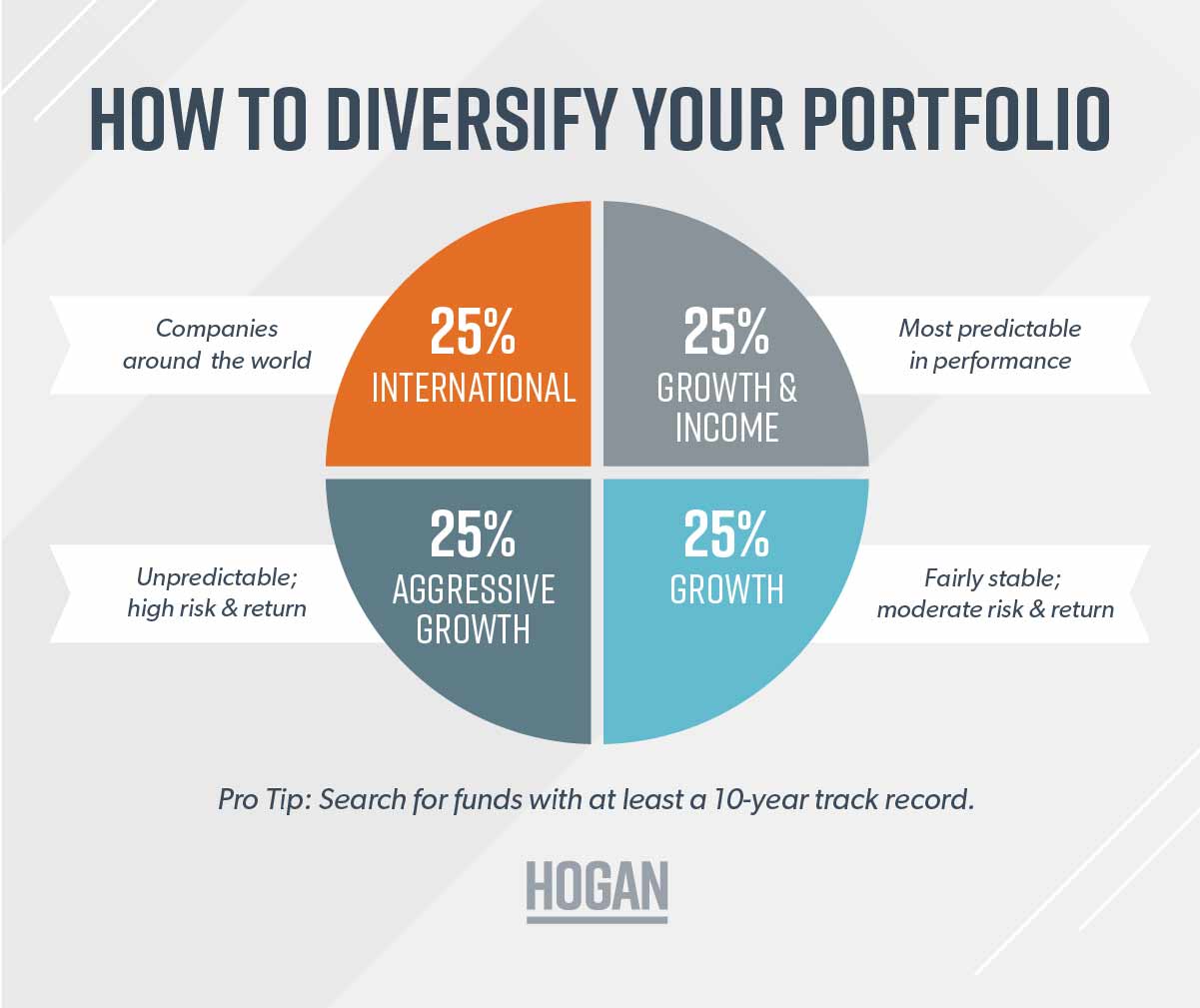

Investment diversification is a crucial aspect of managing risk and optimizing returns in a portfolio. By spreading investments across various asset classes, sectors, and geographic regions, investors can minimize the impact of volatility in any single investment. Let’s explore some key strategies for effective investment diversification.

Asset Allocation

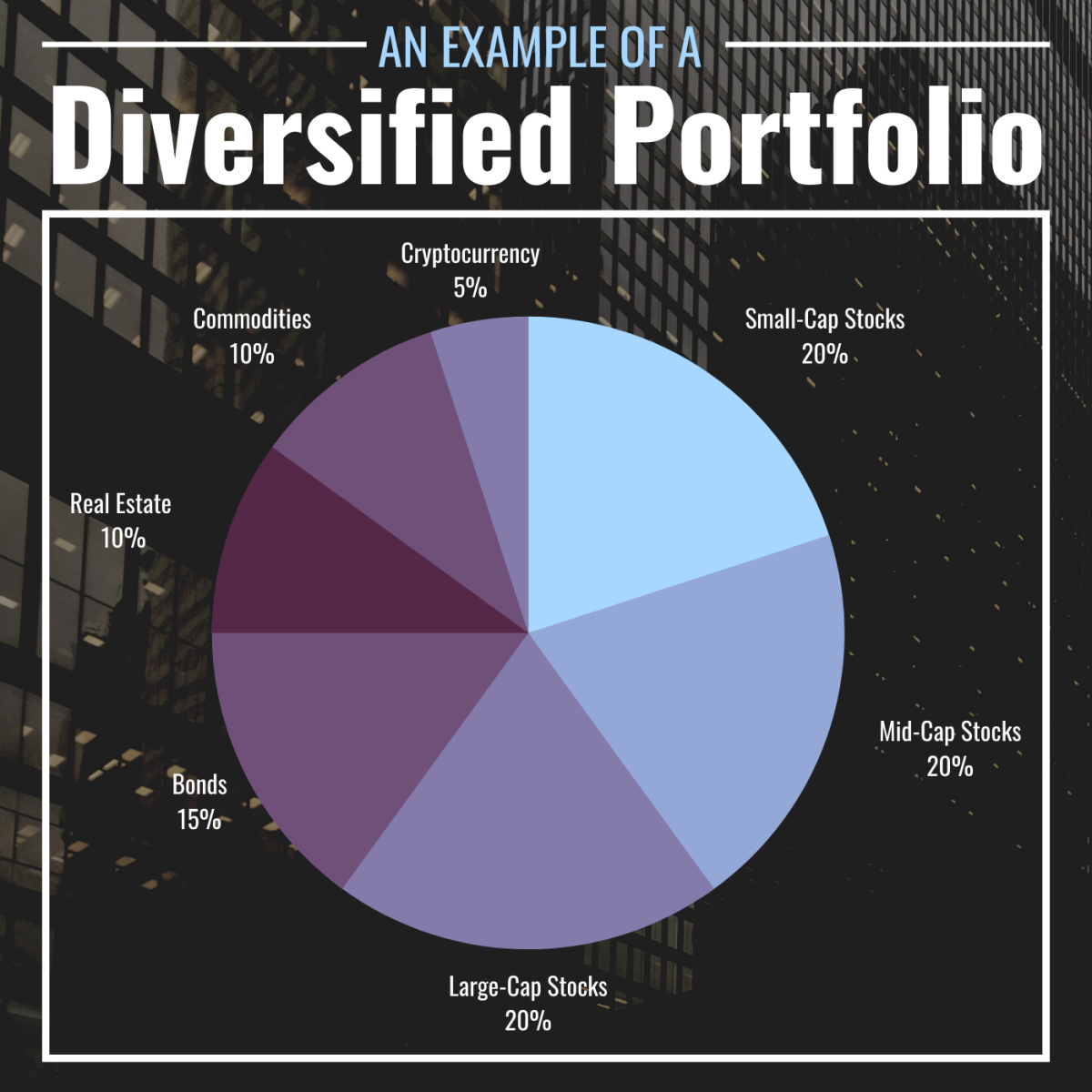

Asset allocation involves dividing your investment portfolio among different asset classes such as stocks, bonds, real estate, and cash equivalents. This strategy aims to balance risk and return by adjusting the percentage of each asset class based on your investment goals, risk tolerance, and time horizon.

- Diversifying across asset classes helps reduce the overall risk of your portfolio since different asset classes tend to react differently to market conditions.

- It allows you to capture opportunities for growth in different market segments, ensuring that your portfolio remains resilient in various economic environments.

- However, asset allocation does not guarantee profits or protect against losses, as all investments carry some level of risk.

Sector Diversification

Sector diversification involves investing in various industry sectors to reduce the risk associated with a particular sector’s performance. By spreading investments across sectors such as technology, healthcare, consumer goods, and energy, investors can minimize the impact of sector-specific risks.

- Investing in multiple sectors helps mitigate the risk of sector downturns, as different sectors may perform well when others are struggling.

- However, over-diversification across sectors may lead to diluted returns, so it’s essential to strike a balance based on your investment objectives.

Geographic Diversification

Geographic diversification entails investing in different regions or countries to reduce the risk associated with localized economic events or geopolitical factors. By spreading investments globally, investors can benefit from diverse market opportunities and avoid overexposure to a single market.

- Geographic diversification can provide protection against country-specific risks and currency fluctuations, promoting a more stable and resilient portfolio.

- However, investing in foreign markets comes with its own set of risks, including political instability, regulatory challenges, and currency exchange rate fluctuations.

Asset Classes for Diversification

When it comes to investment diversification, spreading your funds across different asset classes is key to managing risk and maximizing returns. Let’s explore the various asset classes suitable for diversification and how they behave under different market conditions.

Stocks

- Stocks represent ownership in a company and can offer the potential for high returns.

- They are more volatile compared to other asset classes and tend to perform well in a growing economy.

- During economic downturns, stock prices may decline significantly, so they come with higher risk.

Bonds

- Bonds are debt securities issued by governments or corporations, providing a fixed income stream.

- They are considered less risky than stocks and can act as a hedge during market volatility.

- In times of economic uncertainty, bond prices tend to rise as investors seek safer investments.

Real Estate

- Real estate investments involve buying properties or real estate securities for income generation.

- They offer diversification benefits and can act as a hedge against inflation.

- Real estate tends to be less liquid compared to stocks and bonds, but it can provide stable returns over the long term.

Commodities

- Commodities like gold, oil, and agricultural products can serve as a hedge against inflation and currency devaluation.

- They have a low correlation with traditional asset classes, making them a valuable addition to a diversified portfolio.

- Commodity prices are influenced by supply and demand dynamics, geopolitical factors, and global economic conditions.

Combining Asset Classes

By combining different asset classes in your investment portfolio, you can create a balanced mix that reduces overall risk. For example, when stocks perform poorly, bonds or real estate investments may help offset the losses. Diversification allows you to benefit from the strengths of each asset class while minimizing the impact of their weaknesses. It’s essential to regularly review and rebalance your portfolio to ensure it aligns with your financial goals and risk tolerance.

Risk Management with Diversification

Diversification is a crucial strategy that helps investors manage different types of risks, such as market risk, inflation risk, and currency risk. By spreading investments across various asset classes, industries, and geographic regions, diversification can help reduce the impact of negative events on a single investment.

Protection Against Market Downturns

Diversification can protect against losses during market downturns by ensuring that not all investments are tied to the performance of a single market or asset class. For example, if one sector experiences a downturn, investments in other sectors may continue to perform well, balancing out potential losses.

- Diversifying across asset classes like stocks, bonds, real estate, and commodities can help mitigate the impact of market volatility.

- Allocating investments globally can reduce the risk of being overly exposed to the performance of a single country’s economy.

- Including different industries in a portfolio can help spread risk, as certain sectors may perform better than others during specific market conditions.

Importance of Portfolio Review and Rebalancing

It is essential to periodically review and rebalance a diversified portfolio to ensure that it remains aligned with the investor’s risk tolerance and financial goals. Market conditions and asset performance can change over time, impacting the overall risk profile of the portfolio.

- Regularly assessing the performance of investments and adjusting allocations can help maintain the desired level of diversification.

- Rebalancing involves selling overperforming assets and buying underperforming ones to bring the portfolio back to its target asset allocation.

- By rebalancing, investors can take advantage of buying opportunities in undervalued assets and reduce exposure to overvalued ones.