Long-term vs. short-term investments

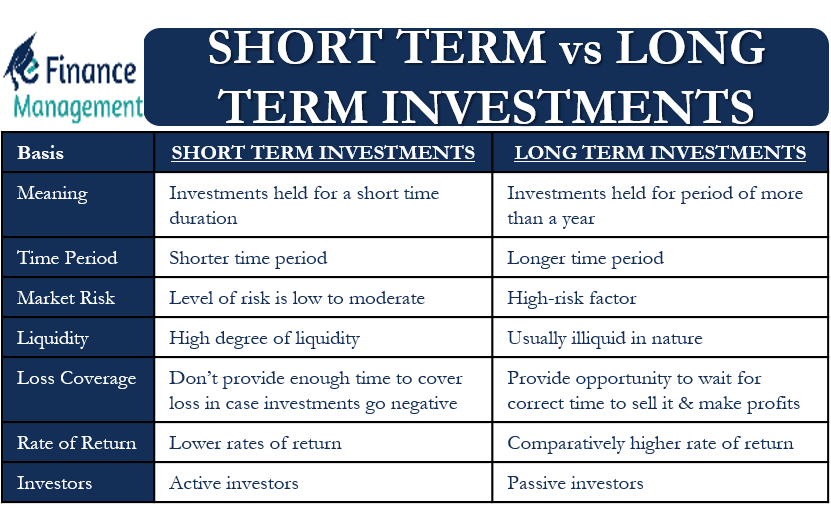

When it comes to investing, one of the key decisions investors need to make is whether to opt for long-term or short-term investments. Let’s explore the differences between the two and the options available for each.

Long-term Investment Options

Long-term investments are typically held for several years, aiming to build wealth over time. Some examples of long-term investment options include:

- Stocks: Investing in shares of companies with strong growth potential.

- Bonds: Purchasing government or corporate bonds for steady income.

- Real Estate: Buying properties to generate rental income and potential appreciation.

- Retirement Accounts: Contributing to 401(k) or IRA accounts for retirement savings.

Short-term Investment Vehicles

Short-term investments are usually held for a few days to a few months, focusing on quick returns or liquidity. Some examples of short-term investment vehicles include:

- Savings Accounts: Storing money in a bank savings account for easy access.

- Certificates of Deposit (CDs): Depositing funds in CDs for a fixed period at a fixed interest rate.

- Treasury Bills: Investing in short-term government securities with maturities of one year or less.

- Money Market Funds: Investing in low-risk securities with high liquidity.

Benefits of Long-term Investments

Long-term investments offer several advantages over short-term ones, such as:

- Compound Growth: Allowing investments to grow exponentially over time through compounding.

- Tax Benefits: Qualifying for lower tax rates on long-term capital gains compared to short-term gains.

- Less Stress: Avoiding the need to constantly monitor and make decisions based on short-term market fluctuations.

- Building Wealth: Providing the opportunity to accumulate significant wealth through strategic long-term investment planning.

Factors influencing investment horizon

When deciding between long-term and short-term investments, various factors come into play that influence the investment horizon.

Role of Risk Tolerance

Risk tolerance is a crucial factor in determining the investment horizon. Investors with a higher risk tolerance may opt for short-term investments to capitalize on market fluctuations, while those with lower risk tolerance may prefer long-term investments for stability and less exposure to market volatility.

Impact of Financial Goals

Financial goals play a significant role in choosing between long-term and short-term investments. Investors with long-term financial goals, such as retirement planning or wealth accumulation, are more likely to opt for long-term investments to achieve their objectives over an extended period. On the other hand, individuals with short-term financial goals, such as saving for a down payment on a house or funding a vacation, may choose short-term investments for quicker returns.

Effect of Market Conditions

Market conditions can heavily influence the decision to opt for long-term or short-term investments. In a volatile market environment, investors may lean towards short-term investments to take advantage of immediate opportunities or protect their assets from sudden downturns. Conversely, during stable market conditions, investors may be more inclined towards long-term investments for sustained growth and capital appreciation.

Risks associated with long-term and short-term investments

Investing in financial markets always involves some level of risk, and understanding the specific risks associated with long-term and short-term investments is crucial for making informed decisions. Long-term investments typically carry different risks compared to short-term investments due to their varying time horizons and objectives. Let’s delve into the specific risks associated with each investment approach.

Risks of Long-term Investments

Long-term investments are generally held for an extended period, often years or even decades. While this strategy can offer the potential for higher returns, it also comes with its own set of risks:

- Market Risk: Long-term investments are exposed to market fluctuations over an extended period. Economic downturns, geopolitical events, and other external factors can impact the value of your investment.

- Inflation Risk: Over a long period, inflation can erode the purchasing power of your investment returns. It’s essential to ensure that your long-term investments can outpace inflation to preserve your wealth.

- Interest Rate Risk: Changes in interest rates can affect the value of fixed-income securities in a long-term investment portfolio. Rising interest rates can lead to lower bond prices, impacting the overall performance of the investment.

Risks of Short-term Investments

Short-term investments are held for a shorter duration, typically less than a year. While they offer liquidity and quick returns, they also come with specific risks:

- Market Volatility: Short-term investments are more susceptible to market volatility and price fluctuations. Sudden market movements can impact the value of your investment in a short time frame.

- Liquidity Risk: Short-term investments may lack liquidity, making it challenging to sell them quickly without incurring significant losses. This risk is particularly relevant in times of financial stress or market uncertainty.

- Reinvestment Risk: When short-term investments mature or are sold, reinvesting the proceeds at a favorable rate may be challenging, especially in a low-interest-rate environment.

Comparison of Risk Profiles

Long-term investments tend to have a higher tolerance for market fluctuations and are better suited to weathering short-term volatility. In contrast, short-term investments are more sensitive to market movements and require active monitoring to mitigate risks effectively. While long-term investments offer the potential for higher returns, they also come with a higher level of risk compared to short-term investments.

External Factors Impacting Risk Levels

External factors can influence the risk levels of both long-term and short-term investments:

- Economic Conditions: Changes in economic indicators, such as GDP growth, employment rates, and inflation, can impact the performance of both long-term and short-term investments.

- Regulatory Changes: Shifts in regulations governing financial markets can introduce new risks or affect the profitability of investments in both the long-term and short-term horizon.

- Global Events: Geopolitical tensions, natural disasters, or global health crises can have a significant impact on financial markets, affecting the risk levels of investments across different time horizons.

Strategies for balancing long-term and short-term investments

When it comes to investing, finding the right balance between long-term and short-term investments is crucial for achieving financial goals. By incorporating a mix of both strategies, investors can take advantage of different market conditions and minimize risks. Let’s explore some techniques for balancing long-term and short-term investments effectively.

Diversifying Portfolio with a Mix of Long-term and Short-term Investments

One strategy for balancing long-term and short-term investments is diversifying your portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the overall risk exposure. Allocating a portion of your portfolio to long-term investments like stocks or real estate can help you build wealth over time, while maintaining some liquidity through short-term investments like bonds or cash equivalents can provide flexibility for immediate financial needs.

Aligning Investment Choices with Financial Goals

When considering both long-term and short-term investment options, it’s essential to align your choices with your individual financial goals. Determine your risk tolerance, time horizon, and liquidity needs to tailor your investment strategy accordingly. For long-term goals such as retirement planning, focus on growth-oriented assets with higher potential returns. For short-term goals like saving for a major purchase, prioritize investments that offer stability and liquidity.

Adjusting Investment Strategies Based on Market Conditions

Market conditions are constantly changing, and it’s crucial to adjust your investment strategies accordingly. During periods of economic uncertainty or market volatility, consider reallocating your portfolio to reduce risk exposure and preserve capital. Stay informed about market trends, economic indicators, and geopolitical events to make informed decisions about rebalancing your investments between long-term and short-term assets.

Laddering Investments for Balancing Goals

One effective technique for balancing long-term and short-term investment goals is through “laddering” investments. This strategy involves staggering the maturity dates of fixed-income securities like bonds or certificates of deposit (CDs) to spread out liquidity and interest rate risk. By maintaining a laddered portfolio, investors can access funds periodically while taking advantage of higher yields on longer-term investments.