Market Volatility Introduction

Market volatility refers to the degree of variation in the prices of financial instruments in a specific market over a certain period of time. It is a measure of the unpredictability and fluctuations in the value of assets, such as stocks, bonds, and commodities. Understanding market volatility is crucial for investors as it can impact investment decisions, risk management strategies, and overall portfolio performance.

Importance of Market Volatility for Investors

Market volatility is important for investors as it provides opportunities for potential gains but also poses risks. By analyzing and assessing market volatility, investors can make informed decisions about when to buy, sell, or hold investments. For example, during periods of high volatility, investors may choose to diversify their portfolios to reduce risk or take advantage of price fluctuations for profitable trades.

Examples of Recent Market Volatility Events

- The COVID-19 pandemic in 2020 led to a significant increase in market volatility, with global stock markets experiencing sharp declines followed by rapid recoveries.

- The U.S.-China trade war tensions have also contributed to market volatility, impacting investor sentiment and causing fluctuations in stock prices.

- The uncertainty surrounding Brexit negotiations has created volatility in the financial markets, particularly affecting the value of the British pound and European stocks.

Historical Volatility vs. Implied Volatility

When it comes to market volatility, it is important to understand the differences between historical volatility and implied volatility. Historical volatility looks at past price movements, while implied volatility reflects the market’s expectation of future price fluctuations.

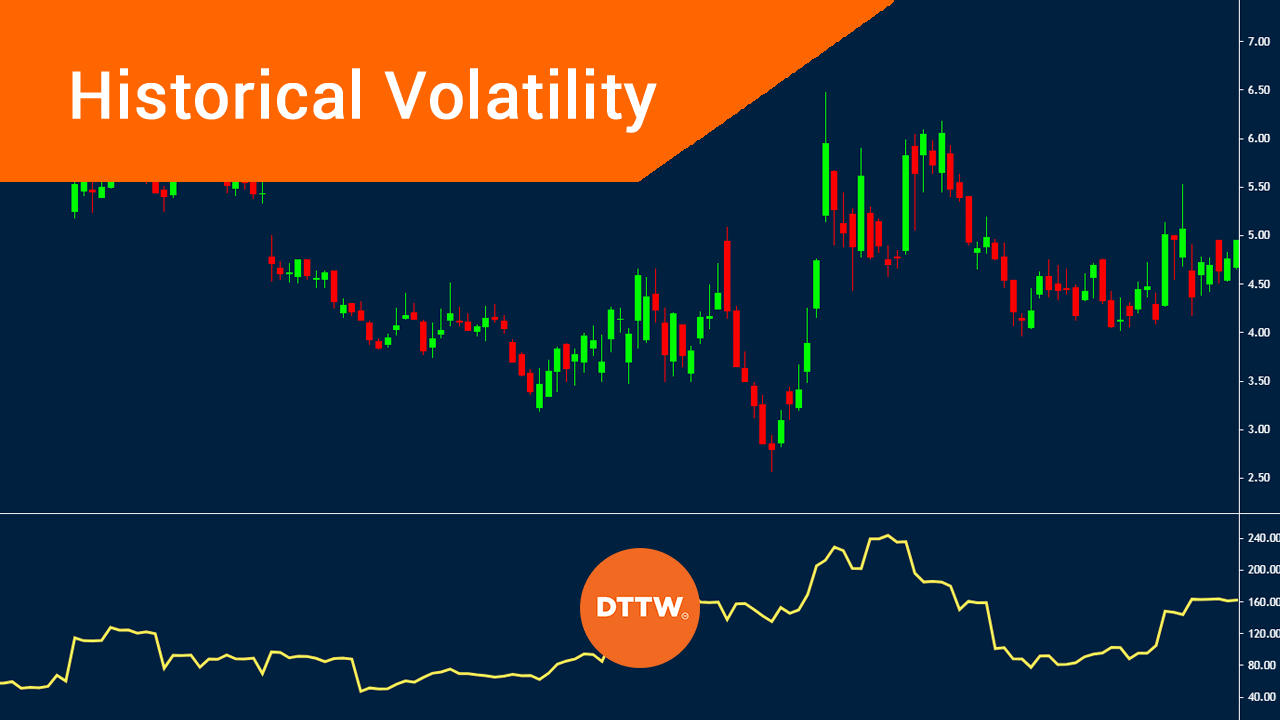

Historical Volatility

Historical volatility is calculated by measuring the standard deviation of past price movements over a specific period. This gives traders an idea of how much an asset’s price has deviated from its average price in the past. The formula for historical volatility is as follows:

Historical Volatility = Standard Deviation of Price Returns * √(Number of trading days in a year)

Factors that influence historical volatility include market events, economic data releases, geopolitical tensions, and overall market sentiment. Traders use historical volatility to gauge the risk associated with an asset and make informed decisions based on past price movements.

Implied Volatility

Implied volatility, on the other hand, is derived from options prices and represents the market’s expectation of how volatile an asset will be in the future. It is often used as a measure of market sentiment and risk perception. Factors that influence implied volatility include demand for options, market conditions, upcoming events, and changes in interest rates.

Traders can use implied volatility to assess the market’s expectations for future price movements and adjust their strategies accordingly. It is important to note that implied volatility can fluctuate rapidly, especially around significant events or news releases.

Common Strategies for Managing Market Volatility

Diversification, hedging, and stop-loss orders are common strategies used by investors to manage market volatility effectively.

Diversification as a Strategy for Managing Market Volatility

Diversification involves spreading investments across different asset classes, industries, or geographic regions to reduce risk. By not putting all your eggs in one basket, diversification helps cushion the impact of market fluctuations on your overall portfolio. For example, if one sector is experiencing a downturn, other investments in your portfolio may still be performing well, minimizing losses.

The Concept of Hedging and its Role in Reducing Risk During Volatile Market Conditions

Hedging is a strategy used to offset potential losses in one investment by taking an opposite position in another asset. This helps protect against adverse price movements in the market. For instance, an investor holding a large position in a particular stock may choose to hedge their investment by purchasing put options to limit losses if the stock price declines. By hedging, investors can mitigate the impact of market volatility on their portfolio.

Using Stop-Loss Orders to Mitigate Losses in a Volatile Market

Stop-loss orders are preset instructions given to a broker to sell a security once it reaches a certain price. These orders help investors limit their losses by automatically executing a sale when the stock price falls to a specified level. By setting stop-loss orders, investors can manage risk in a volatile market environment and prevent significant losses if the market moves against their positions.

Volatility Trading Strategies

Volatility trading involves taking advantage of the fluctuations in the market’s volatility levels. Traders can profit from these price swings by using various strategies that are specifically designed for volatile market conditions.

Options Trading for Capitalizing on Market Volatility

Options trading can be a powerful tool for capitalizing on market volatility. By using options contracts, traders can profit from both rising and falling volatility levels. One popular strategy is to use straddles and strangles to take advantage of expected price movements.

Popular Volatility Trading Strategies

- Straddles: A straddle involves buying both a call option and a put option on the same underlying asset with the same strike price and expiration date. This strategy profits from significant price movements in either direction, regardless of the market’s overall trend.

- Strangles: A strangle is similar to a straddle but involves buying out-of-the-money call and put options with different strike prices. This strategy is used when the trader expects a significant price movement but is unsure about the direction.

Technical Analysis in Volatile Markets

Technical analysis plays a crucial role in helping traders navigate volatile markets by providing insights into market trends, patterns, and potential price movements. By analyzing historical price data and volume, traders can identify key levels of support and resistance, as well as trend reversals, which are essential in making informed trading decisions.

Key Technical Indicators for Volatile Markets

During periods of high volatility, certain technical indicators can be particularly useful in guiding traders. These indicators help in assessing market sentiment, momentum, and potential price direction. Some of the key technical indicators used in volatile markets include:

- 1. Bollinger Bands: These bands help traders visualize the volatility of a market by showing the upper and lower boundaries of price movements. When the bands widen, it indicates increased volatility, while narrowing bands suggest decreased volatility.

- 2. Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements. In volatile markets, RSI can help traders identify overbought or oversold conditions, signaling potential trend reversals.

- 3. Moving Averages: Moving averages help in smoothing out price data to identify trends. Traders use moving averages to determine the overall direction of the market and potential support or resistance levels during periods of high volatility.

Examples of Technical Analysis in Volatile Markets

Traders often use technical analysis to make decisions in volatile markets. For instance, if the Bollinger Bands widen significantly, traders may interpret this as a signal of increased volatility and adjust their risk management strategies accordingly. Similarly, if the RSI indicates an overbought condition, traders might consider taking profits or entering a short position.