Understanding Mutual Funds

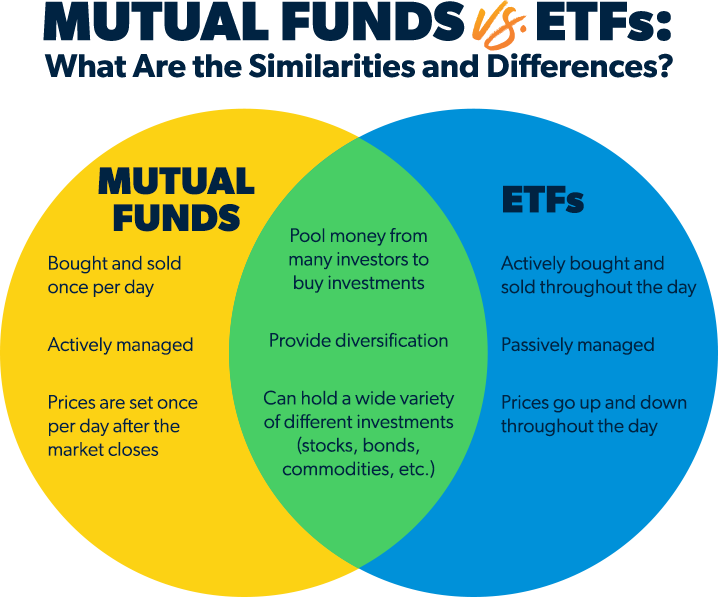

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the investors.

Types of Mutual Funds

- Equity Funds: These funds invest primarily in stocks and are suitable for investors seeking capital appreciation.

- Bond Funds: These funds invest in fixed-income securities like government or corporate bonds, providing regular interest income.

- Money Market Funds: These funds invest in low-risk, short-term debt securities, making them a safe option for preserving capital.

- Index Funds: These funds aim to replicate the performance of a specific market index, offering diversification at a low cost.

Benefits of Investing in Mutual Funds

- Mutual funds provide diversification by investing in a variety of securities, reducing risk.

- Professional management ensures that the fund’s investments are monitored and adjusted as needed.

- Liquidity allows investors to buy or sell mutual fund shares on any business day at the fund’s net asset value (NAV).

- Mutual funds offer accessibility to a wide range of asset classes and investment strategies that may not be available to individual investors.

Understanding ETFs

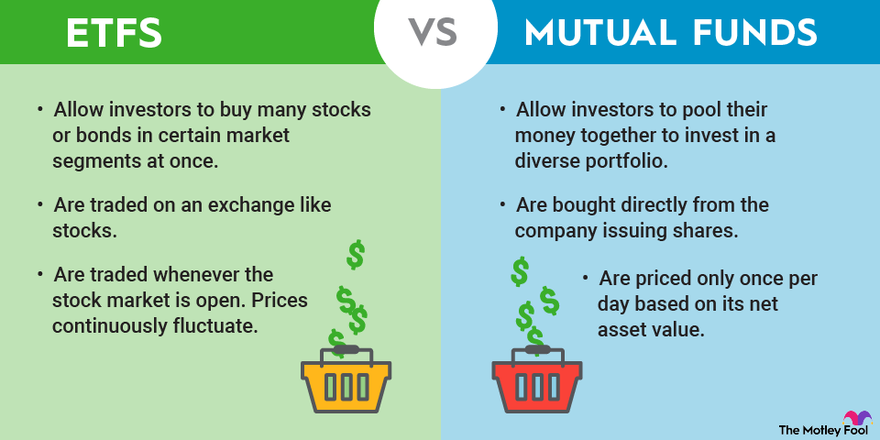

Exchange-traded funds (ETFs) are investment funds that are traded on stock exchanges, similar to individual stocks. They typically hold a basket of securities, such as stocks, bonds, or commodities, and offer investors the opportunity to diversify their portfolios with a single investment.

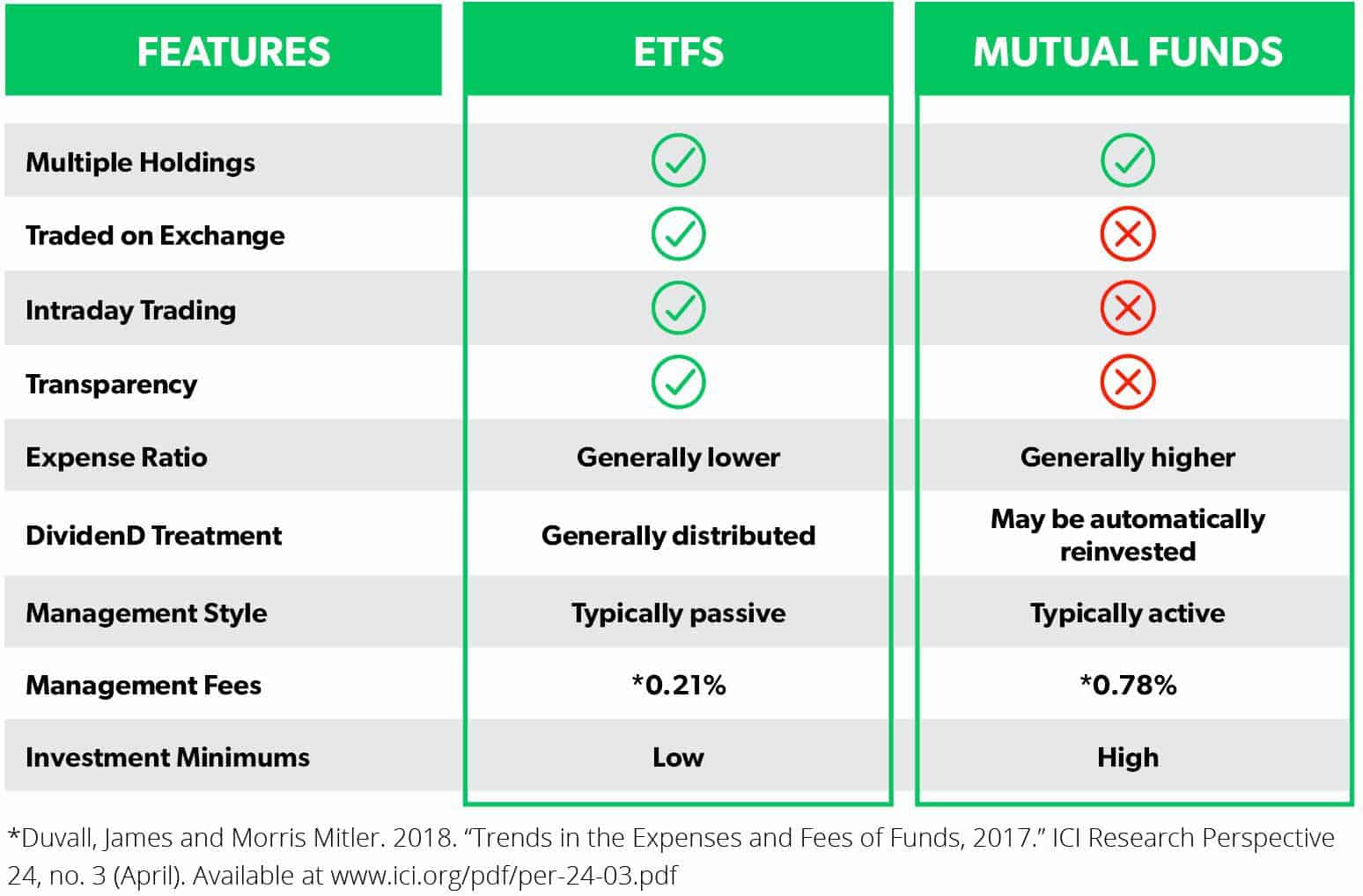

Comparison with Mutual Funds

- ETFs are traded on exchanges like stocks, allowing for intraday trading, while mutual funds are bought and sold at the end of the trading day at the net asset value (NAV).

- ETFs often have lower expense ratios compared to mutual funds, making them a cost-effective investment option.

- ETFs provide more transparency as their holdings are disclosed on a daily basis, whereas mutual funds reveal their holdings periodically.

Benefits of Investing in ETFs

- ETFs offer diversification by holding a variety of assets in a single fund, reducing individual stock risk.

- They provide flexibility in trading, allowing investors to buy and sell throughout the trading day at market prices.

- ETFs often have lower expense ratios and fees compared to mutual funds, helping investors save on costs over the long term.

- They can be tax-efficient, as the structure of ETFs typically results in fewer capital gains distributions compared to mutual funds.

Cost Differences

When it comes to investing in financial products like mutual funds and ETFs, understanding the cost structure is essential. Both options come with their own set of fees and expenses that investors need to consider before making a decision.

Cost Structure of Mutual Funds

Mutual funds typically have higher expense ratios compared to ETFs. These expense ratios cover the costs of managing the fund, including administrative fees, operating expenses, and sometimes sales commissions. Additionally, mutual funds may charge investors loads, which are sales charges either when purchasing (front-end load) or redeeming (back-end load) shares of the fund.

Cost Structure of ETFs

ETFs generally have lower expense ratios compared to mutual funds. These expense ratios are typically lower because of the passive management style of most ETFs, which aim to track a specific index rather than actively managed mutual funds. Additionally, ETFs do not charge loads like mutual funds, making them more cost-effective for investors.

Comparison of Costs

– Mutual funds tend to have higher expense ratios due to active management and other fees, while ETFs usually have lower expense ratios due to passive management.

– Mutual funds may charge loads, which can eat into investors’ returns, while ETFs do not have these types of sales charges.

– Overall, investing in ETFs may be more cost-effective in terms of fees and expenses compared to mutual funds.

Liquidity and Trading

When it comes to investing in mutual funds or ETFs, understanding the liquidity and ease of trading is essential for investors to make informed decisions.

Liquidity of Mutual Funds

Mutual funds are known for their liquidity, as investors can buy or sell their shares at the end of the trading day at the net asset value (NAV). However, the actual execution of the trade occurs after the market closes, which can impact the price at which the transaction is completed.

Liquidity of ETFs

ETFs offer higher liquidity compared to mutual funds as they can be bought and sold throughout the trading day at market prices. This real-time pricing allows investors to take advantage of intraday market movements and execute trades more quickly.

Comparison of Trading Ease

- Mutual Funds: Trading mutual funds is relatively straightforward, with transactions occurring at the end of the trading day based on the NAV. However, investors must wait until the market closes to execute their trades.

- ETFs: ETFs provide greater flexibility in trading, allowing investors to buy and sell shares throughout the trading day. This real-time trading feature can be advantageous for investors looking to capitalize on short-term market opportunities.

Tax Efficiency

Investors often consider the tax implications of their investments to maximize returns. Let’s explore how mutual funds and ETFs differ in terms of tax efficiency.

Tax Implications of Investing in Mutual Funds

When you invest in mutual funds, you may be subject to capital gains taxes on any profits realized when the fund manager sells securities within the fund. This can lead to potential tax liabilities for investors, even if they did not personally sell any shares. Additionally, mutual funds may distribute dividends, interest, or capital gains to shareholders, which are taxable in the year they are received.

Tax Implications of Investing in ETFs

ETFs are generally considered more tax-efficient than mutual funds. This is because ETFs typically have lower portfolio turnover, which reduces the frequency of capital gains distributions. Additionally, when an investor sells shares of an ETF, they are subject to capital gains tax based on their individual transactions, rather than the entire fund’s activity.

Comparing Tax Efficiency of Mutual Funds and ETFs

In summary, ETFs tend to be more tax-efficient than mutual funds due to their structure and lower turnover rates. Investors in ETFs may have more control over their tax liabilities and may experience fewer unexpected tax consequences compared to mutual fund investors. It’s essential to consider the tax implications of each investment option when building your portfolio to optimize your after-tax returns.