Retirement Investment Options

Diversification is a key strategy when it comes to building a retirement investment portfolio. By spreading your investments across different asset classes, you can reduce the overall risk of your portfolio. This means that if one investment underperforms, it may be offset by another that performs well.

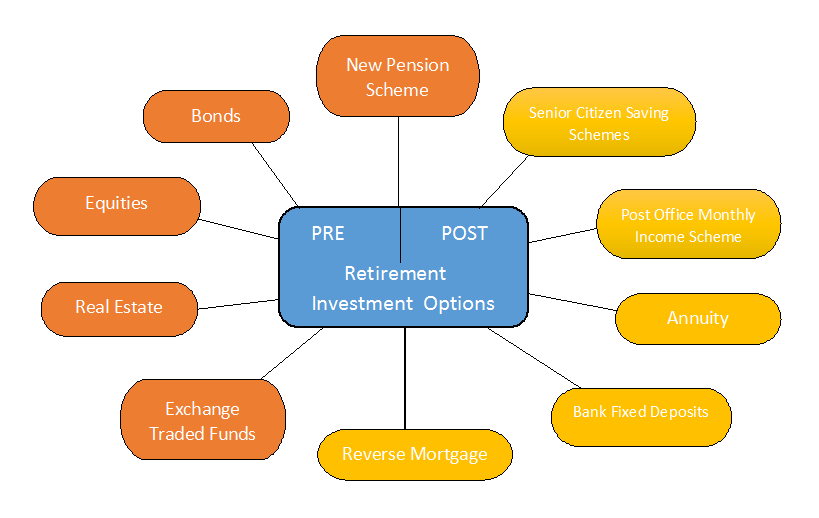

Types of Retirement Investment Vehicles

- 401(k): A 401(k) is an employer-sponsored retirement plan that allows employees to contribute a portion of their pre-tax salary to a retirement account. Employers may also match a percentage of these contributions.

- IRA (Individual Retirement Account): An IRA is a tax-advantaged investment account that individuals can open on their own. Contributions to a traditional IRA may be tax-deductible, while contributions to a Roth IRA are made with after-tax dollars.

- Annuities: An annuity is a financial product that provides a series of payments to the investor over a set period of time. Annuities can be fixed or variable, offering different levels of risk and return.

Risks Associated with Retirement Investment Options

- 401(k): Market risk is a significant factor in 401(k) investments, as the value of your account can fluctuate based on the performance of the underlying investments.

- IRA: Risks associated with IRAs include market risk, inflation risk, and longevity risk. Inflation can erode the purchasing power of your retirement savings over time.

- Annuities: Risks with annuities include interest rate risk, inflation risk, and liquidity risk. Annuities may also have high fees and penalties for early withdrawal.

Tax Implications of Retirement Investment Options

- 401(k): Contributions to a traditional 401(k) are made with pre-tax dollars, reducing your taxable income in the year of contribution. Withdrawals in retirement are taxed as ordinary income.

- IRA: Traditional IRA contributions may be tax-deductible, but withdrawals are taxed as ordinary income. Roth IRA contributions are made with after-tax dollars, and qualified withdrawals are tax-free.

- Annuities: The tax treatment of annuities can vary depending on the type. Earnings in an annuity grow tax-deferred, but withdrawals may be subject to income tax.

Traditional vs. Roth Accounts

When it comes to retirement accounts, two popular options are traditional and Roth accounts. Each has its own set of rules and benefits. Let’s dive into the key differences between the two.

Contributions and Withdrawals

In a traditional retirement account, contributions are made with pre-tax dollars, which means you can deduct the amount from your taxable income in the year you make the contribution. However, withdrawals in retirement are taxed as ordinary income.

On the other hand, Roth retirement accounts are funded with after-tax dollars, so you don’t get a tax deduction when you make contributions. The advantage comes during retirement when withdrawals are tax-free, including any investment gains.

Eligibility Criteria and Income Limits for Roth IRAs

To contribute to a Roth IRA, there are income limits that determine if you are eligible. For single filers, the income limit starts phasing out at $125,000 and is completely phased out at $140,000. For married couples filing jointly, the phase-out begins at $198,000 and is fully phased out at $208,000.

Tax Advantages Comparison

In terms of tax advantages, traditional accounts offer immediate tax deductions on contributions, but withdrawals are taxed in retirement. Roth accounts, on the other hand, do not provide a tax deduction upfront but offer tax-free withdrawals during retirement.

Investment Strategies for Retirement

When planning for retirement, it is crucial to consider various investment strategies that can help you achieve your financial goals and secure your future.

Asset Allocation:

Asset allocation is the process of dividing your investment portfolio among different asset classes such as stocks, bonds, and cash equivalents. This strategy helps in managing risk and maximizing returns based on your risk tolerance and investment goals. It is essential in retirement investing as it ensures a diversified portfolio that can withstand market fluctuations.

Benefits of Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you regularly invest a fixed amount of money at scheduled intervals, regardless of market fluctuations. This approach helps in reducing the impact of market volatility on your investments and allows you to buy more shares when prices are low and fewer shares when prices are high. Over time, this can result in a lower average cost per share and potentially higher returns.

- Reduces the risk of making emotional investment decisions based on short-term market movements.

- Offers a disciplined approach to investing and helps in building wealth over the long term.

- Smoothens out the impact of market fluctuations on your investment returns.

Tips for Adjusting Investment Strategies as Retirement Approaches

As retirement approaches, it is essential to make adjustments to your investment strategies to protect your savings and ensure a steady income stream during retirement. Here are some tips to consider:

- Shift towards more conservative investments to preserve capital and reduce risk.

- Consider reallocating your portfolio to generate income through dividends and interest payments.

- Review and adjust your asset allocation based on your changing risk tolerance and financial needs.

Factors to Consider

When choosing retirement investment options, individuals should consider various factors to ensure they align with their financial goals and risk tolerance. Factors to consider include the impact of inflation, risk tolerance, investment timeline, and overall financial goals.

Impact of Inflation on Retirement Investments

Inflation can erode the purchasing power of retirement investments over time. To mitigate the impact of inflation, consider investing in assets that have the potential to outpace inflation, such as stocks or real estate. Additionally, incorporating inflation-protected securities like Treasury Inflation-Protected Securities (TIPS) can help safeguard the value of your investments against inflation.

Role of Risk Tolerance and Investment Timeline

Your risk tolerance and investment timeline play a crucial role in selecting suitable retirement investments. Determine how much risk you are willing to take and align your investments accordingly. For individuals with a longer investment timeline, they may have the flexibility to take on more risk for potentially higher returns. On the other hand, those with a shorter timeline may opt for more conservative investments to protect their capital.

Aligning Retirement Investment Choices with Financial Goals

It is essential to align your retirement investment choices with your overall financial goals. Consider factors such as your desired retirement lifestyle, anticipated expenses, and retirement age when making investment decisions. Ensure that your investment choices are in line with your long-term financial objectives to build a sustainable retirement portfolio.