Overview of Retirement Planning for Self-Employed Individuals

Retirement planning is crucial for self-employed individuals as it ensures financial stability and security during their retirement years. Unlike traditional employees who may have access to employer-sponsored retirement plans, self-employed individuals are responsible for creating and managing their own retirement savings.

Key Differences in Retirement Planning

- Self-employed individuals do not have access to employer-sponsored 401(k) or pension plans, requiring them to set up their own retirement accounts such as a SEP-IRA or Solo 401(k).

- They have the flexibility to contribute varying amounts to their retirement savings each year based on their income, unlike traditional employees who may have fixed contribution limits.

- Self-employed individuals must actively monitor and adjust their retirement savings strategy as their income fluctuates, whereas employees may have a more consistent income stream.

Challenges Faced by Self-Employed Individuals

- Irregular Income: Self-employed individuals often experience fluctuating income levels, making it challenging to consistently save for retirement.

- Lack of Employer Contributions: Without employer contributions to a retirement plan, self-employed individuals bear the full responsibility of funding their retirement.

- Complexity of Investment Decisions: Self-employed individuals must make investment decisions for their retirement savings, which can be daunting for those without a financial background.

Retirement Savings Options for Self-Employed Individuals

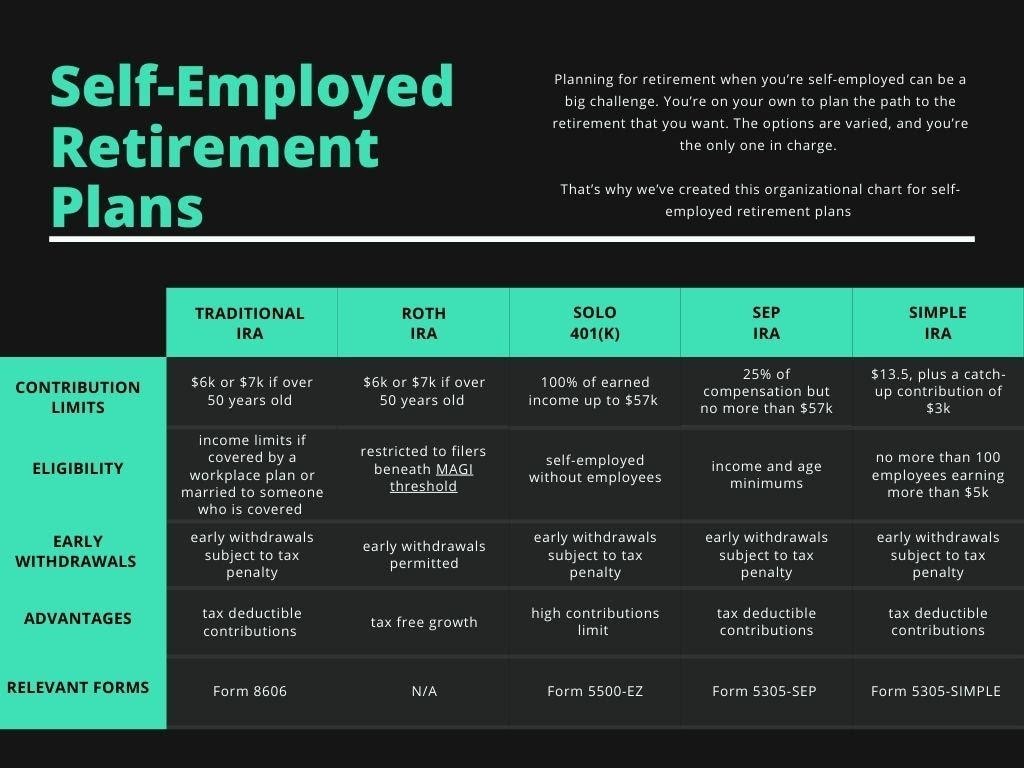

When it comes to saving for retirement as a self-employed individual, there are several options to consider. Each option has its own set of rules, contribution limits, and tax benefits. Let’s compare and contrast some of the most common retirement savings options available to self-employed individuals.

SEP-IRA (Simplified Employee Pension Individual Retirement Account)

A SEP-IRA is a retirement plan that allows self-employed individuals to contribute a percentage of their income into a tax-deferred account. The main features of a SEP-IRA include:

- Contributions are made by the employer (you, as the self-employed individual).

- Contribution limits are based on a percentage of your income, up to a certain annual maximum.

- Contributions are tax-deductible, reducing your taxable income for the year.

- Withdrawals in retirement are taxed as ordinary income.

Solo 401(k)

A Solo 401(k) is a retirement plan designed for self-employed individuals with no employees other than a spouse. Here are some key points about the Solo 401(k):

- You can make contributions both as the employer and the employee, allowing for higher contribution limits compared to other retirement plans.

- Contribution limits consist of an employee elective deferral contribution and an employer profit-sharing contribution.

- Contributions are tax-deductible, reducing your taxable income for the year.

- Withdrawals in retirement are taxed as ordinary income.

SIMPLE IRA (Savings Incentive Match Plan for Employees Individual Retirement Account)

A SIMPLE IRA is a retirement plan that allows both the employer and the employee to make contributions. Here’s what you need to know about a SIMPLE IRA:

- Employer contributions are mandatory, either as a matching contribution or a non-elective contribution.

- Employee contributions can be made through salary deferrals.

- Contribution limits are lower compared to a Solo 401(k) but still offer a tax-advantaged way to save for retirement.

- Contributions are tax-deductible, reducing your taxable income for the year.

- Withdrawals in retirement are taxed as ordinary income.

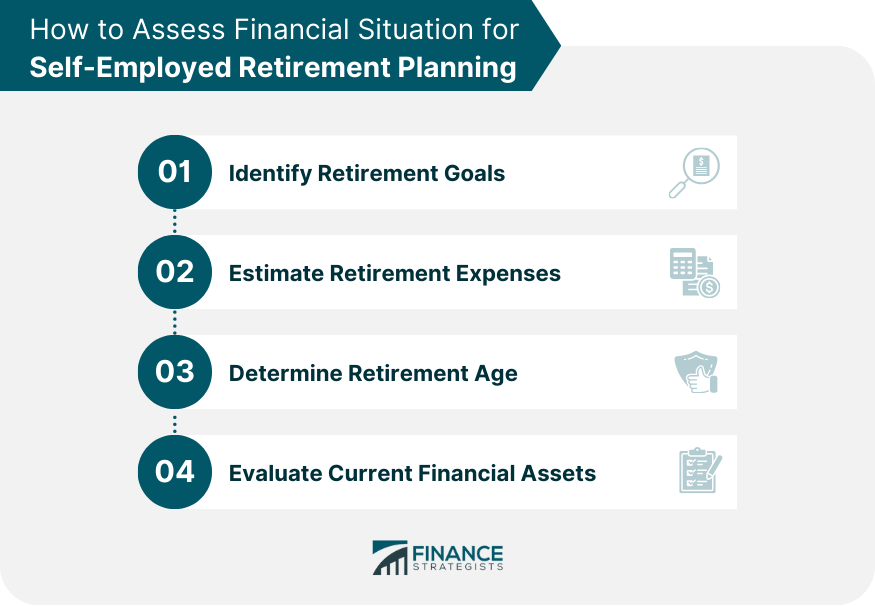

Setting Retirement Goals and Creating a Retirement Plan

Setting retirement goals and creating a solid retirement plan are essential steps for self-employed individuals to ensure a secure financial future. By determining clear retirement goals and following a comprehensive plan, individuals can work towards achieving financial independence in their retirement years.

Determining Retirement Goals

- Start by envisioning your ideal retirement lifestyle. Consider factors such as where you want to live, how you plan to spend your time, and any specific goals you have for your retirement years.

- Calculate the potential costs associated with your retirement goals. This includes estimating expenses for housing, healthcare, travel, leisure activities, and any other expenses you anticipate.

- Set specific and measurable financial targets. Determine how much you need to save for retirement based on your desired lifestyle and projected expenses.

Creating a Comprehensive Retirement Plan

- Assess your current financial situation, including income, expenses, assets, and debts. Understanding where you stand financially will help you develop a realistic retirement plan.

- Explore retirement savings options and choose the most suitable retirement accounts for your needs. Consider factors such as tax advantages, investment options, and contribution limits.

- Develop a savings strategy that aligns with your retirement goals. Set up automatic contributions to your retirement accounts and regularly monitor your progress towards meeting your financial targets.

Regularly Reviewing and Adjusting the Retirement Plan

- Regularly review your retirement plan to ensure it remains aligned with your goals and financial situation. Life circumstances and priorities may change, requiring adjustments to your plan.

- Monitor the performance of your retirement accounts and make necessary changes to your investment strategy based on market conditions and your risk tolerance.

- Consult with a financial advisor periodically to get professional guidance on optimizing your retirement plan and making informed decisions about your financial future.

Investment Strategies for Retirement Planning

When it comes to retirement planning for self-employed individuals, choosing the right investment strategies is crucial to ensure a secure financial future. Let’s explore different investment options tailored for retirement savings.

Risk Tolerance and Time Horizon Considerations

Before diving into specific investment strategies, it’s essential to consider your risk tolerance and time horizon. Risk tolerance refers to how comfortable you are with the possibility of losing money on your investments, while the time horizon is the length of time you have until retirement. Individuals with a longer time horizon can afford to take on more risk, as they have more time to recover from potential losses.

Examples of Diversified Investment Portfolios

Creating a diversified investment portfolio can help mitigate risk and maximize returns. Here are some examples of diversified portfolios suitable for retirement planning:

- 1. Stocks and Bonds Portfolio: This portfolio includes a mix of stocks and bonds to balance risk and return. Stocks offer higher growth potential but come with higher volatility, while bonds provide stability and income.

- 2. Mutual Funds Portfolio: Investing in mutual funds allows you to access a diversified portfolio managed by professional fund managers. They offer instant diversification across various asset classes.

- 3. Real Estate Investment Portfolio: Investing in real estate properties can provide a steady stream of rental income and potential appreciation in property value. It offers a tangible asset that can act as a hedge against inflation.

- 4. Retirement Accounts Portfolio: Contributing to retirement accounts such as a 401(k) or IRA can provide tax advantages and help grow your savings over time. These accounts offer a range of investment options to suit your risk tolerance and goals.

Tax Implications and Retirement Planning

When it comes to retirement planning for self-employed individuals, understanding the tax implications is crucial. Different retirement savings options have varying tax consequences, and it’s essential to consider these factors when creating a retirement plan.

Tax Implications of Different Retirement Savings Options

- Traditional IRA: Contributions to a traditional IRA are typically tax-deductible, which can lower your taxable income for the year. However, withdrawals during retirement are taxed as ordinary income.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, so withdrawals in retirement are tax-free. This can provide tax diversification in retirement by allowing you to choose between taxable and tax-free income sources.

- Solo 401(k): Contributions to a Solo 401(k) are tax-deductible, reducing your taxable income. Withdrawals during retirement are taxed as ordinary income.

Strategies to Minimize Taxes and Maximize Tax Efficiency

- Consider a combination of traditional and Roth retirement accounts to manage tax diversification in retirement.

- Utilize tax-efficient investment strategies, such as investing in index funds with low turnover to minimize capital gains taxes.

- Plan your withdrawals strategically in retirement to avoid unnecessary taxes, such as taking advantage of lower tax brackets or utilizing tax-efficient withdrawal methods.

Impact of Tax Laws on Retirement Planning Decisions

- Changes in tax laws and regulations can impact the tax treatment of retirement accounts and investments, influencing the overall tax efficiency of your retirement plan.

- Understanding the current tax landscape and staying informed about potential tax law changes can help you make informed decisions when planning for retirement.

- Consulting with a tax professional or financial advisor can provide personalized guidance on navigating tax implications and optimizing your retirement plan for tax efficiency.