What is Tax-efficient investing?

Tax-efficient investing refers to the strategy of minimizing the impact of taxes on investment returns. It involves structuring investment portfolios in a way that reduces tax liabilities and maximizes after-tax returns.

Importance of tax-efficient investing in financial planning lies in the potential to enhance overall investment performance by reducing the amount of taxes paid on investment gains. By implementing tax-efficient strategies, investors can potentially keep more of their investment returns, leading to higher long-term wealth accumulation.

Benefits of Tax-efficient Investing

- Utilizing tax-advantaged accounts: Investing in retirement accounts like 401(k)s or IRAs allows for tax-deferred growth, minimizing current tax liabilities.

- Harvesting tax losses: Selling investments at a loss to offset gains and reduce taxable income.

- Choosing tax-efficient investments: Opting for investments with lower turnover rates and qualified dividends to reduce tax implications.

Tax-deferred vs. Taxable Accounts

Investing in tax-efficient accounts can have a significant impact on your overall returns. Understanding the key differences between tax-deferred and taxable investment accounts is crucial for making informed financial decisions.

Tax-deferred accounts, such as Traditional IRAs and 401(k)s, offer investors the benefit of tax-deferred growth. This means that you do not pay taxes on the contributions or earnings within these accounts until you withdraw the funds in retirement. By deferring taxes, your investments can grow faster due to compounding interest over time.

On the other hand, taxable investment accounts are subject to annual taxes on any dividends, interest, or capital gains earned. Capital gains tax is incurred when you sell an investment for a profit. The tax rate on capital gains depends on how long you held the investment before selling, with long-term capital gains typically taxed at a lower rate than short-term gains.

Tax-deferred Accounts: IRAs and 401(k)s

Tax-deferred accounts like Traditional IRAs and 401(k)s allow investors to contribute pre-tax dollars, lowering their taxable income in the current year. This can result in immediate tax savings, as contributions are deducted from your taxable income.

- Contributions and earnings in tax-deferred accounts grow tax-free until withdrawal in retirement.

- Withdrawals in retirement are taxed as ordinary income, potentially at a lower tax rate if you are in a lower income bracket during retirement.

- Required minimum distributions (RMDs) begin at age 72 for Traditional IRAs and 401(k)s, ensuring that you eventually pay taxes on the funds.

Taxable Investment Accounts

Taxable investment accounts, such as brokerage accounts, do not offer the same tax advantages as tax-deferred accounts. Investors are required to pay taxes on any income generated within these accounts each year.

- Capital gains taxes are incurred when selling investments for a profit, with long-term gains taxed at a lower rate than short-term gains.

- Dividends and interest earned in taxable accounts are subject to annual taxes, reducing the overall return on investments.

- There is no limit on contributions to taxable accounts, providing more flexibility in terms of access to funds without penalties.

Tax-efficient Investment Strategies

Tax-efficient investment strategies are crucial for maximizing returns by minimizing tax liabilities. Two key strategies for achieving tax efficiency are asset location and tax-loss harvesting.

Asset Location

Asset location involves strategically placing assets in different account types to minimize taxes. By allocating investments with higher tax implications, such as bonds or real estate investment trusts (REITs), in tax-advantaged accounts like a 401(k) or IRA, investors can reduce their tax burden. On the other hand, assets with lower tax consequences, such as stocks eligible for long-term capital gains, can be held in taxable brokerage accounts.

Tax-loss Harvesting

Tax-loss harvesting is a strategy used to offset capital gains by selling investments at a loss. By realizing losses, investors can reduce their taxable income and overall tax liability. This technique can be particularly beneficial during market downturns when there may be opportunities to sell underperforming assets at a loss to offset gains realized elsewhere in the portfolio.

Impact of Taxes on Investment Returns

When it comes to investing, taxes can significantly impact your overall returns over time. Understanding how taxes affect your investments is crucial in maximizing your after-tax returns.

Tax Impact on Different Types of Investments

Let’s take a look at how taxes can erode investment returns for various types of investments:

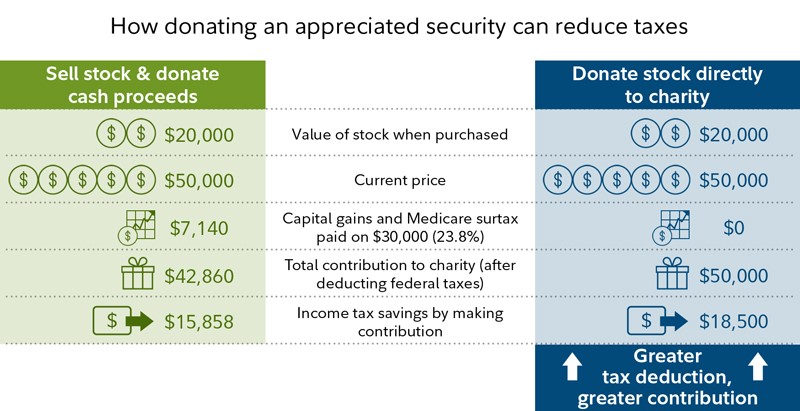

- Stocks: When you sell stocks that have appreciated in value, you may be subject to capital gains taxes. This can reduce your overall return on investment.

- Bonds: Interest income from bonds is typically taxed at your ordinary income tax rate. This can eat into your returns, especially if you are in a higher tax bracket.

- Mutual Funds: Mutual funds distribute capital gains to shareholders, which are taxable. Even if you don’t sell your shares, you may still have to pay taxes on these distributions.

Ways to Mitigate Tax Consequences

Here are some strategies to help minimize the impact of taxes on your investments:

- Utilize tax-advantaged accounts like IRAs and 401(k)s, where your investments can grow tax-deferred or tax-free.

- Consider tax-efficient investment strategies such as holding investments for the long term to take advantage of lower capital gains tax rates.

- Harvest tax losses to offset gains and reduce your tax liability.