Importance of Credit Reports

Credit reports play a crucial role in an individual’s financial health by providing a comprehensive overview of their credit history and behavior. Understanding credit reports is essential for making informed financial decisions and maintaining a healthy credit score.

Impact on Various Aspects of Life

Credit reports can impact various aspects of life, including:

- Loan Approvals: Lenders use credit reports to assess an individual’s creditworthiness when applying for loans, mortgages, or credit cards. A good credit report can increase the chances of loan approval and access to favorable terms.

- Employment Opportunities: Some employers may check credit reports as part of the hiring process, especially for positions that involve financial responsibilities. A negative credit report could potentially affect job prospects.

- Insurance Premiums: Insurance companies may consider credit reports when determining insurance premiums. A poor credit report could lead to higher insurance costs.

- Rental Applications: Landlords may request credit reports when evaluating rental applications. A positive credit report can increase the likelihood of securing a rental property.

Significance of Regularly Checking and Understanding Credit Reports

Regularly checking and understanding credit reports is crucial for the following reasons:

- Identity Theft Detection: Monitoring credit reports can help detect unauthorized activity or potential identity theft early on.

- Error Correction: Reviewing credit reports allows individuals to identify and correct any errors or inaccuracies that could negatively impact their credit score.

- Improving Credit Score: By understanding the factors that influence credit scores, individuals can take steps to improve their credit profile over time.

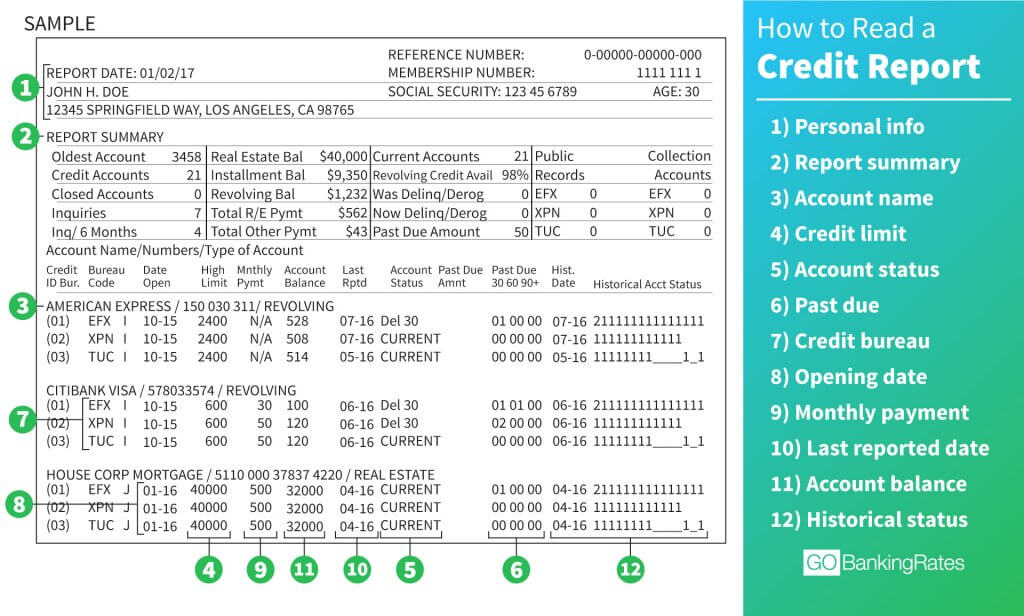

Components of a Credit Report

When looking at a credit report, there are several key sections that provide a comprehensive overview of an individual’s credit history and financial behavior. Each section plays a vital role in determining a person’s creditworthiness and overall credit profile.

1. Personal Information

The personal information section includes details such as the individual’s name, address, date of birth, social security number, and employment information. This section helps to verify the identity of the individual and ensure that the credit report belongs to the correct person.

2. Account History

The account history section provides a detailed record of the individual’s credit accounts, including credit cards, loans, and mortgages. It includes information on the account balance, payment history, credit limit, and any late payments or defaults. Lenders use this section to assess how responsible the individual is in managing their credit obligations.

3. Inquiries

The inquiries section lists all the inquiries made on the individual’s credit report, including both hard inquiries (initiated by the individual for credit applications) and soft inquiries (initiated by lenders for pre-approval offers). Multiple hard inquiries within a short period can negatively impact the credit score, as it may suggest financial distress or a high reliance on credit.

4. Public Records

Public records such as bankruptcies, foreclosures, tax liens, and civil judgments are included in this section. These negative marks can significantly impact an individual’s credit score and indicate financial instability or irresponsibility. Lenders view public records as red flags and may be hesitant to extend credit to individuals with such derogatory marks on their credit report.

5. Credit Score

While not a section in the traditional sense, the credit score is a numerical representation of an individual’s creditworthiness based on the information in the credit report. It summarizes the overall credit risk and helps lenders quickly assess an individual’s creditworthiness. A higher credit score indicates lower risk, making it easier to qualify for loans and credit at favorable terms.

Credit Score vs. Credit Report

When it comes to understanding your financial health, it’s essential to differentiate between a credit score and a credit report. While both are related to your credit history, they serve different purposes and provide distinct information.

Credit scores are numerical representations of your creditworthiness, ranging from 300 to 850 in most cases. This three-digit number is calculated based on the information found in your credit report. Factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries all play a role in determining your credit score.

Your credit report, on the other hand, is a detailed record of your credit history, including information about your credit accounts, payment history, and any negative marks such as late payments or accounts in collections. It provides a comprehensive overview of how you have managed credit in the past and serves as the basis for your credit score.

Calculation of Credit Scores

Credit scores are calculated using complex algorithms that analyze the data in your credit report. Each credit bureau may use slightly different scoring models, but the most commonly used is the FICO score, developed by the Fair Isaac Corporation. This score takes into account various factors from your credit report to generate a number that indicates your credit risk.

- Payment history: This is the most significant factor in determining your credit score, accounting for about 35% of the total.

- Amounts owed: The amount of credit you are currently using compared to your total available credit, known as credit utilization, makes up around 30% of your score.

- Length of credit history: How long you have been using credit impacts about 15% of your score.

- New credit: Opening multiple new credit accounts in a short period can negatively affect your score, making up around 10%.

- Credit mix: Having a diverse mix of credit accounts, such as credit cards, auto loans, and mortgages, can positively impact your score, accounting for about 10%.

It’s important to regularly review both your credit report and credit score to ensure there are no errors or fraudulent activity that could be negatively impacting your financial health.

Reading and Interpreting a Credit Report

Understanding how to read and interpret a credit report is crucial for managing your financial health. Here is a step-by-step guide to help you navigate through this important document.

Common Terms and Codes in Credit Reports

- Account Number: The unique identifier assigned to each credit account.

- Payment History: A record of whether you have made payments on time or have been delinquent.

- Credit Limit: The maximum amount you can borrow on a credit account.

- Utilization Rate: The percentage of your available credit that you are currently using.

- Public Records: Information about bankruptcies, liens, or judgments that may impact your credit.

Tips for Identifying Errors in a Credit Report

- Regularly review your credit report to spot any inaccuracies or discrepancies.

- Check for misspelled names, incorrect account information, or unauthorized inquiries.

- Look out for accounts that you do not recognize, as this could indicate identity theft.

- If you find errors, dispute them with the credit bureau to have them corrected.

Impact of Credit Reports on Financial Decisions

Credit reports play a crucial role in shaping various financial opportunities for individuals. Lenders, landlords, insurance companies, and even potential employers often rely on credit reports to make informed decisions regarding creditworthiness and financial responsibility.

Loan Approvals, Interest Rates, and Credit Limits

- Credit reports are used by lenders to assess a borrower’s credit risk when applying for a loan.

- A strong credit report with a high credit score can lead to faster loan approvals, lower interest rates, and higher credit limits.

- On the other hand, a poor credit report may result in loan denials, higher interest rates, and lower credit limits.

Renting an Apartment, Getting Insurance, or Applying for a Job

- Landlords often check credit reports to evaluate a tenant’s ability to pay rent on time and manage finances responsibly.

- Insurance companies may consider credit reports when determining premiums for auto or home insurance policies.

- Employers in certain industries may review credit reports as part of the hiring process to assess an individual’s financial stability and trustworthiness.

Real-Life Examples of Credit Report Impact

- Example 1: Sarah, who maintained a healthy credit report, was able to secure a mortgage at a favorable interest rate, saving her thousands of dollars over the life of the loan.

- Example 2: John, with a poor credit report due to missed payments, faced difficulties in renting an apartment and had to pay a higher security deposit.

- Example 3: Emily, who had a strong credit report, received a job offer over another candidate with a lower credit score, showcasing the importance of creditworthiness in the hiring process.

Improving and Maintaining a Good Credit Report

Maintaining a positive credit report is crucial for financial well-being. It can impact your ability to secure loans, get approved for credit cards, or even rent an apartment. Here are some strategies to improve and maintain a good credit report:

Strategies for Improving a Credit Report

- Pay bills on time: Late payments can significantly impact your credit score. Set up reminders or automatic payments to ensure timely payments.

- Reduce debt: High credit utilization can negatively affect your credit score. Aim to keep your credit card balances low relative to your credit limit.

- Check for errors: Regularly review your credit report for any inaccuracies or fraudulent activities. Dispute any errors with the credit reporting agencies to have them corrected.

Importance of Maintaining a Positive Credit Report

Maintaining a positive credit report over time can lead to better interest rates on loans, higher credit limits, and increased financial opportunities. It demonstrates financial responsibility and can help you achieve your long-term financial goals.

Resources for Monitoring and Managing Credit Reports

- AnnualCreditReport.com: This website allows you to access your credit report from all three major credit reporting agencies for free once a year.

- Credit monitoring services: Consider enrolling in a credit monitoring service that alerts you to any changes in your credit report, such as new accounts opened in your name or credit inquiries.

- Credit score apps: Utilize mobile apps that provide credit score updates and tips on improving your credit health.