Importance of Retirement Account Contributions

Contributing to retirement accounts is crucial for ensuring financial security in the future. By consistently saving for retirement, individuals can build a nest egg that will support them during their golden years.

Impact on Financial Security

Retirement account contributions play a vital role in securing financial stability post-retirement. By saving early and regularly, individuals can accumulate a substantial amount that can help cover living expenses, healthcare costs, and other needs during retirement.

Advantages of Consistent Retirement Savings

- Compound Interest: Contributions made to retirement accounts have the potential to grow over time with the power of compound interest, allowing individuals to maximize their savings.

- Tax Benefits: Many retirement accounts offer tax advantages, such as tax-deferred growth or tax-free withdrawals, helping individuals save more for retirement.

- Diversification: Retirement accounts provide a range of investment options, allowing individuals to diversify their portfolio and reduce risk.

Commonly Used Retirement Accounts

- 401(k): A popular employer-sponsored retirement account where employees can contribute a portion of their salary, often with employer matching contributions.

- IRA (Individual Retirement Account): A personal retirement account that individuals can open independently, offering various tax advantages depending on the type (traditional or Roth).

- 403(b): Similar to a 401(k) but available to employees of certain non-profit organizations, schools, and governmental entities.

Types of Retirement Accounts

When it comes to planning for retirement, there are several types of retirement accounts to consider. Each type has its own set of features, eligibility criteria, and contribution limits. Let’s explore some of the most common retirement account options:

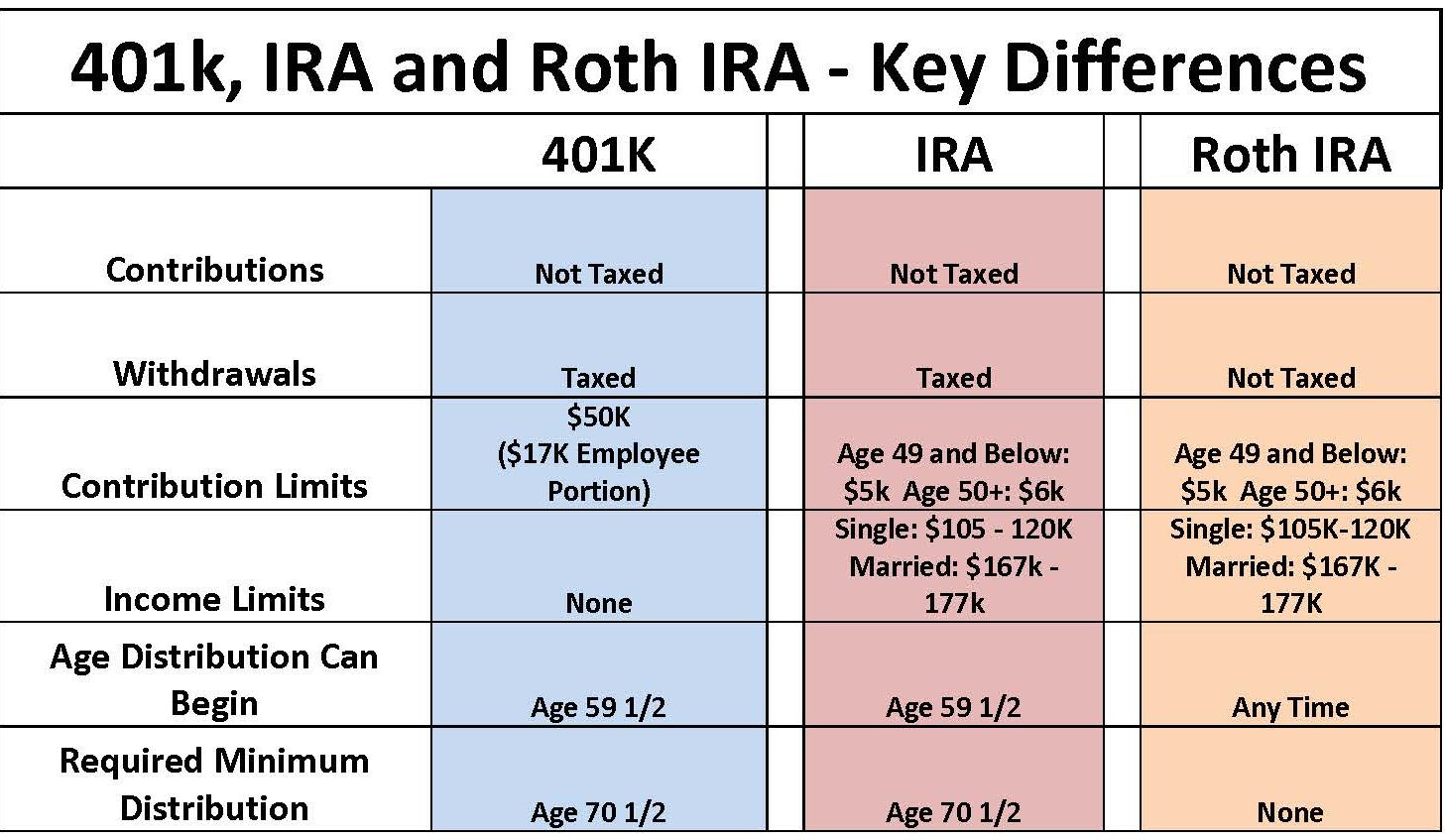

401(k) Retirement Account

- A 401(k) is an employer-sponsored retirement account where employees can contribute a portion of their pre-tax income.

- Employers may also match a percentage of the employee’s contributions, providing an additional benefit.

- Contributions are tax-deferred, meaning taxes are not paid on the money until it is withdrawn in retirement.

- There are annual contribution limits set by the IRS, which can vary each year.

Individual Retirement Account (IRA)

- An IRA is a retirement account that individuals can open independently of their employer.

- There are different types of IRAs, including Traditional IRAs and Roth IRAs, each with its own tax advantages.

- Contributions to a Traditional IRA may be tax-deductible, while Roth IRA contributions are made with after-tax dollars.

- There are income limits for contributing to a Roth IRA, but anyone with earned income can contribute to a Traditional IRA.

Roth IRA

- A Roth IRA is a type of retirement account where contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

- Roth IRAs have income limits for eligibility, making them more accessible to lower-income individuals.

- There are no required minimum distributions (RMDs) for Roth IRAs during the account holder’s lifetime.

- Contributions to a Roth IRA are subject to annual limits set by the IRS.

Strategies for Maximizing Retirement Contributions

When it comes to maximizing retirement contributions, there are several strategies that individuals can employ to secure their financial future. These strategies can help you make the most out of your retirement savings and ensure a comfortable life after you stop working.

Employer Matching Contributions

Employer matching contributions are essentially free money that your employer adds to your retirement account based on a percentage of your own contributions. It is crucial to take full advantage of this benefit by contributing enough to receive the maximum match offered by your employer. This can significantly boost your retirement savings without any extra effort on your part.

Catch-Up Contributions

For individuals nearing retirement age, catch-up contributions allow them to contribute additional funds to their retirement accounts beyond the usual limits. This is especially helpful for those who may have fallen behind on their savings goals and need to make up for lost time. By taking advantage of catch-up contributions, you can accelerate your retirement savings and better prepare for your future.

Investment Strategies

When it comes to investing within your retirement accounts, it’s important to consider your risk tolerance, time horizon, and financial goals. Diversifying your investments, regularly reviewing your portfolio, and adjusting your asset allocation as needed can help you maximize returns while minimizing risk. Whether you prefer a hands-on approach or opt for a more passive strategy, the key is to stay informed and make informed decisions to grow your retirement savings over time.

Tax Implications of Retirement Account Contributions

When it comes to retirement account contributions, it’s essential to understand how they can impact your taxes. By contributing to retirement accounts, individuals can benefit from various tax advantages that can help them save money in the long run.

Tax Advantages of Contributing to Retirement Accounts

- Contributions to traditional retirement accounts, such as a 401(k) or Traditional IRA, are typically made with pre-tax dollars. This means that the amount you contribute is deducted from your taxable income for the year, reducing the amount of income subject to taxation.

- On the other hand, contributions to Roth retirement accounts, like a Roth IRA or Roth 401(k), are made with after-tax dollars. While you don’t get an immediate tax deduction, qualified withdrawals from Roth accounts in retirement are tax-free.

- Additionally, both types of retirement accounts offer tax-deferred growth, meaning that any investment gains within the account are not taxed until you withdraw the funds in retirement.

Withdrawals from Retirement Accounts

- Withdrawals from traditional retirement accounts are taxed as ordinary income in the year they are taken. This means that you will owe income taxes on the amount withdrawn at your current tax rate.

- On the other hand, withdrawals from Roth retirement accounts are typically tax-free, as long as they are qualified distributions. This can provide significant tax advantages in retirement when you may be in a lower tax bracket.

- It’s important to note that there are penalties for early withdrawals from retirement accounts before the age of 59 ½, which can further impact your taxes.