What are index funds?

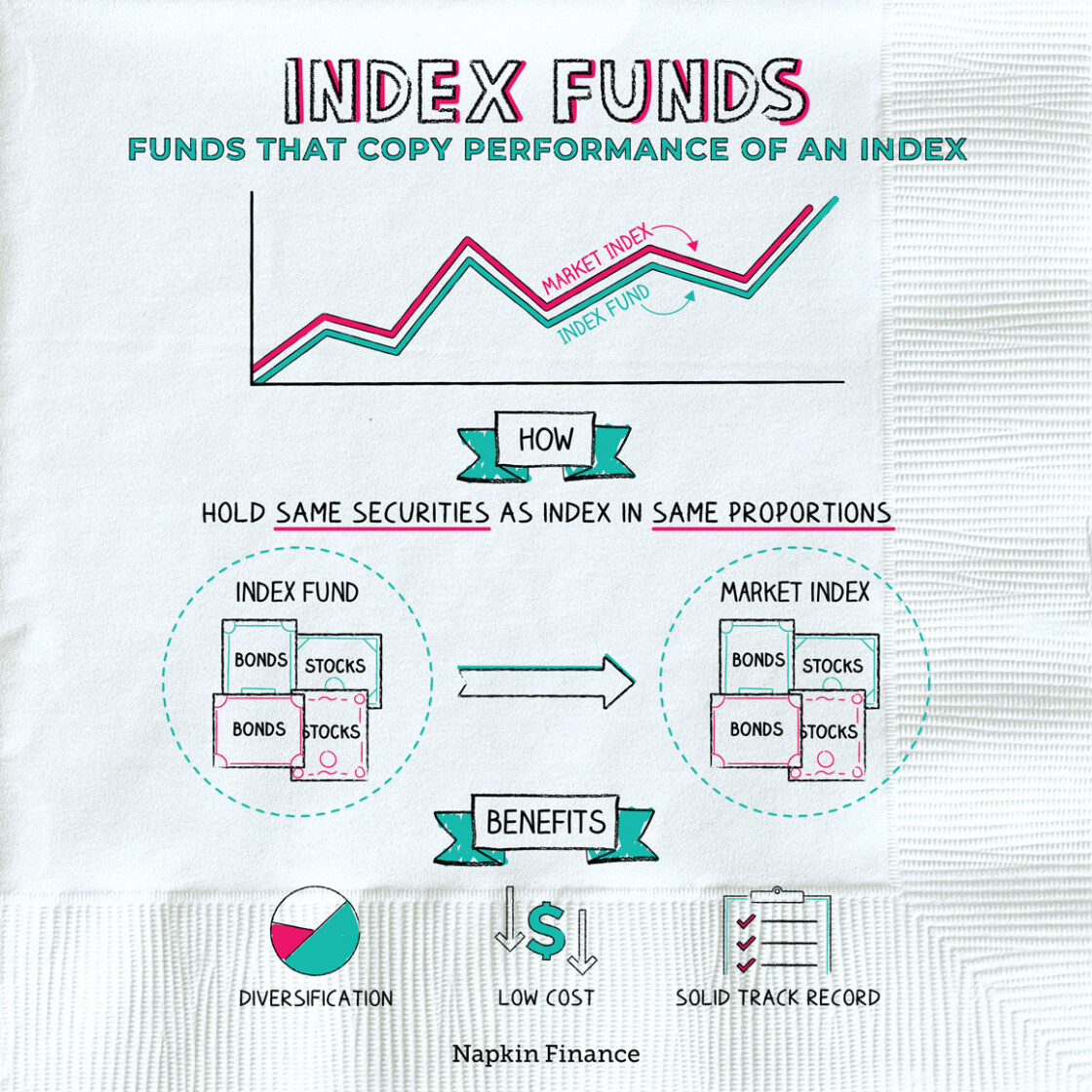

Index funds are a type of mutual fund or exchange-traded fund (ETF) that is designed to track the performance of a specific market index. Instead of trying to outperform the market, index funds aim to replicate the returns of a particular index, such as the S&P 500 or the Dow Jones Industrial Average.

How do index funds work?

Index funds work by investing in a diversified portfolio of securities that mirror the components of the chosen index. This passive investment approach eliminates the need for a fund manager to make active investment decisions, resulting in lower management fees compared to actively managed funds. By holding a mix of stocks or bonds that match the index, index funds provide investors with broad market exposure and are considered a cost-effective way to gain diversified investment exposure.

Examples of popular index funds

- Vanguard 500 Index Fund (VFIAX): This index fund tracks the performance of the S&P 500, which consists of 500 of the largest publicly traded companies in the United States.

- iShares Core MSCI EAFE ETF (IEFA): This fund follows the MSCI EAFE Index, which includes large and mid-cap stocks from developed markets outside of North America.

- Schwab U.S. Broad Market ETF (SCHB): This ETF seeks to match the performance of the Dow Jones U.S. Broad Stock Market Index, providing exposure to a wide range of U.S. stocks.

Benefits of investing in index funds

Investing in index funds offers several advantages that make them an attractive option for investors.

Performance Comparison with Actively Managed Funds

Index funds typically have lower fees compared to actively managed funds, which can eat into your returns over time. Additionally, research has shown that over the long term, index funds tend to outperform actively managed funds due to their lower costs and consistent performance.

Diversification

Index funds provide investors with instant diversification by holding a wide range of stocks or bonds that make up a specific index. This helps reduce risk by spreading your investments across different companies and industries. As a result, investors are less exposed to the volatility of individual stocks or sectors.

Considerations before investing in index funds

Before diving into investing in index funds, there are several key factors to consider to make an informed decision. It is important to understand the risks associated with investing in index funds and how expense ratios can impact your returns.

Identifying key factors before investing in index funds

- Understand the underlying index: Before investing, make sure you understand the index that the fund is tracking. Different indexes have different compositions and objectives.

- Risk tolerance: Assess your risk tolerance and investment goals to determine if index funds align with your financial objectives.

- Diversification: Index funds provide instant diversification, but it’s essential to consider your overall investment portfolio diversification.

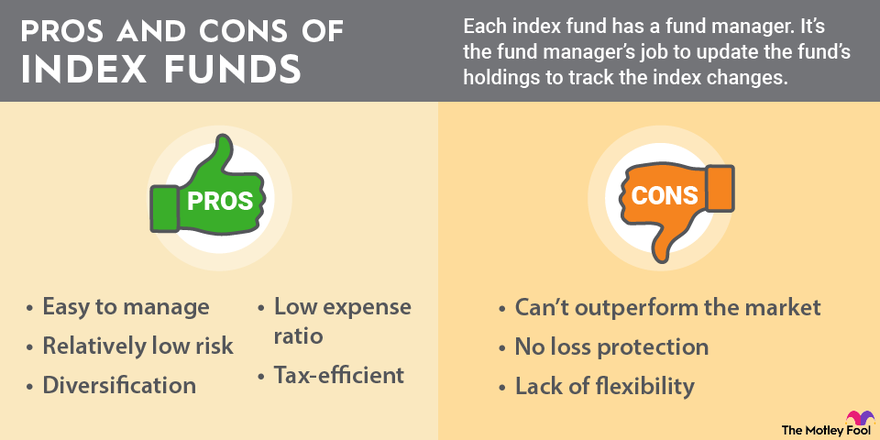

Risks associated with investing in index funds

- Market risk: As index funds track the performance of a specific index, they are subject to market fluctuations and volatility.

- Tracking error: There may be a slight variance between the fund’s performance and the index it is tracking, known as tracking error.

- Lack of flexibility: Index funds have a passive investment strategy, limiting the ability to actively manage investments based on market conditions.

Impact of expense ratios on returns of index funds

Expense ratios play a crucial role in determining the overall returns of an index fund. These ratios represent the fees and expenses associated with managing the fund. The lower the expense ratio, the higher the net returns for investors. It’s essential to compare expense ratios across different index funds to ensure you are getting the best value for your investment.

How to start investing in index funds

Investing in index funds can be a great way to build wealth over time with minimal effort. Here are the steps to begin investing in index funds:

Choosing the right index funds

When selecting index funds for your investment goals, consider the following tips:

- Identify your investment goals: Determine whether you are investing for retirement, saving for a major purchase, or other financial objectives.

- Understand your risk tolerance: Assess how much risk you are willing to take on with your investments.

- Research different index funds: Look into various index funds that align with your goals and risk tolerance.

- Compare expense ratios: Consider the fees associated with each index fund to ensure you are getting a good value.

- Diversify your investments: Spread your investments across different asset classes to reduce risk.

Monitoring and managing index fund investments

Once you have invested in index funds, it’s essential to monitor and manage your investments effectively:

- Regularly review your portfolio: Keep track of how your investments are performing and make adjustments as needed.

- Rebalance your portfolio: Periodically rebalance your portfolio to maintain your desired asset allocation.

- Stay informed: Stay up to date on market trends and economic news that may impact your investments.

- Consult with a financial advisor: Consider seeking professional advice to ensure your investment strategy aligns with your financial goals.