Overview of Health Savings Accounts (HSAs)

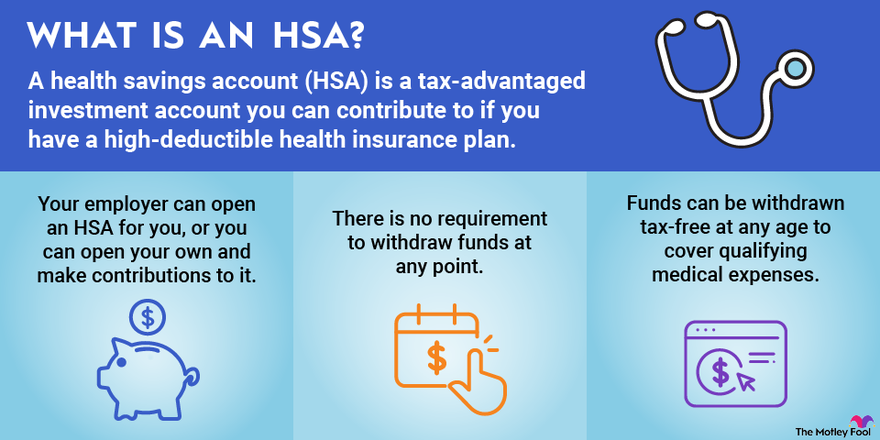

Health Savings Accounts (HSAs) are tax-advantaged accounts that individuals can use to save money for qualified medical expenses. These accounts are usually paired with high-deductible health insurance plans. Here’s how they work:

Benefits of Having an HSA

- Contributions to an HSA are tax-deductible, reducing your taxable income.

- Any interest or investment earnings on the account are tax-free.

- Withdrawals for qualified medical expenses are also tax-free.

- The money in an HSA rolls over from year to year, so there is no “use it or lose it” rule like with Flexible Spending Accounts (FSAs).

Comparison of HSAs to Other Healthcare Accounts

When comparing HSAs to other types of healthcare accounts like FSAs, there are some key differences:

- Unlike FSAs, the funds in an HSA are owned by the individual and are portable, meaning they can be taken from job to job.

- HSAs have higher contribution limits than FSAs, providing the opportunity to save more money for healthcare expenses.

- While FSAs have a “use it or lose it” rule where funds not used by the end of the plan year are forfeited, HSAs allow for unused funds to carry over indefinitely.

Eligibility and Contributions

To open a Health Savings Account (HSA), individuals must meet certain eligibility criteria. Generally, you are eligible to open an HSA if you are covered by a High Deductible Health Plan (HDHP), not enrolled in Medicare, not claimed as a dependent on someone else’s tax return, and do not have other health coverage that is not an HDHP.

Contribution Limits

- For 2021, the contribution limit for an individual with self-only coverage is $3,600, and for those with family coverage, it is $7,200.

- Individuals aged 55 or older can make an additional catch-up contribution of $1,000 per year.

Tax Advantages

Contributing to an HSA offers several tax advantages:

- Contributions are tax-deductible, meaning you can reduce your taxable income by the amount you contribute to the HSA.

- Interest and investment earnings on the HSA funds grow tax-free.

- Withdrawals for qualified medical expenses are tax-free, making HSAs a triple tax-advantaged account.

Using Funds from HSAs

Health Savings Accounts (HSAs) offer flexibility in using funds for qualified medical expenses. These accounts allow account holders to cover a variety of medical costs with tax-advantaged funds.

Qualified Medical Expenses Covered by an HSA

HSAs can be used to pay for a wide range of medical expenses, including but not limited to:

- Doctor visits

- Prescription medications

- Dental care

- Vision care

- Medical equipment

Reimbursing Yourself for Medical Expenses

If you pay for a qualified medical expense out of pocket, you can reimburse yourself from your HSA. The process typically involves:

- Keep receipts and documentation of the medical expense.

- Submit a reimbursement request to your HSA provider, either online or by mail.

- Receive the funds directly to your bank account or HSA debit card.

Investment Options and Growth

When it comes to Health Savings Accounts (HSAs), one of the key benefits is the ability to invest your HSA funds to help them grow over time. Let’s take a closer look at the investment options available and how HSA funds can grow compared to other savings or investment accounts.

Investment Options Available

For HSA funds, you typically have the option to invest in a variety of financial instruments such as mutual funds, stocks, bonds, and exchange-traded funds (ETFs). These options allow you to potentially earn a higher return on your HSA funds compared to leaving them in a traditional savings account.

Growth Potential of HSA Funds

By investing your HSA funds wisely, you have the opportunity for them to grow over time through the power of compound interest. As your investments generate returns, those earnings can be reinvested to potentially accelerate the growth of your HSA funds. This can help you build a substantial nest egg for future healthcare expenses.

Comparing Growth Potential

When comparing the growth potential of HSA funds to other savings or investment accounts, HSAs stand out due to their unique tax advantages. HSA contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This tax-free growth can result in significant savings over time, making HSAs a compelling option for both short-term healthcare expenses and long-term savings goals.

Portability and Rollovers

When it comes to Health Savings Accounts (HSAs), portability and rollovers play a crucial role in ensuring flexibility and long-term benefits for account holders.

Portability of HSAs

HSAs are highly portable, meaning you can take your account with you if you change jobs or switch insurance plans. This mobility allows you to continue using the funds accumulated in your HSA for qualified medical expenses, regardless of your employment status or insurance provider.

Rollovers and Benefits

One of the key benefits of HSAs is the ability to roll over unused funds from year to year. Unlike Flexible Spending Accounts (FSAs) that have a “use it or lose it” rule, HSAs allow you to carry over any remaining balance indefinitely. This feature enables account holders to save and grow their funds over time, building a substantial healthcare nest egg for future needs.

Implications of Closing an HSA Account

Closing an HSA account typically occurs when an individual is no longer eligible for an HSA or decides to stop contributing to the account. In such cases, it’s important to understand the implications of closing the account. Any remaining funds must still be used for qualified medical expenses to avoid penalties, and depending on the circumstances, there may be tax implications to consider. It’s advisable to consult with a financial advisor or tax professional before closing an HSA account to ensure a smooth transition and compliance with regulations.