What is Peer-to-peer lending?

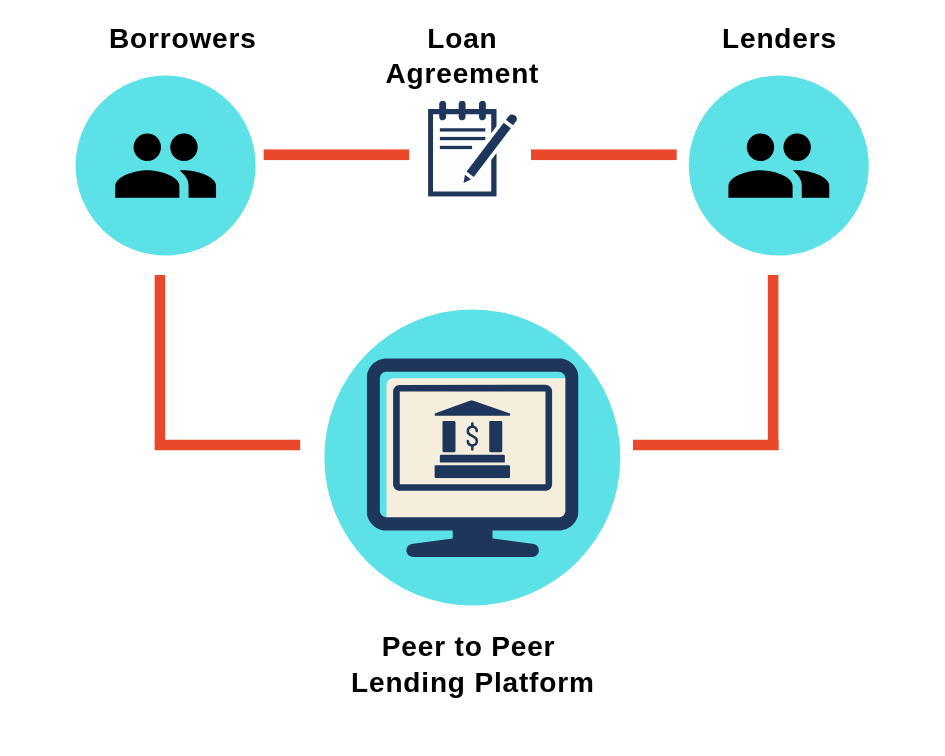

Peer-to-peer lending is a form of lending that connects individuals or businesses looking to borrow money with investors willing to lend funds. Instead of going through traditional financial institutions like banks, borrowers and lenders are matched through online platforms.

How Peer-to-peer lending platforms operate

Peer-to-peer lending platforms serve as intermediaries, facilitating the lending process by providing a platform where borrowers can request loans and investors can fund those loans. These platforms assess borrower creditworthiness, set interest rates, and handle the collection and distribution of payments.

- Investors can choose which loans to fund based on risk and return preferences.

- Borrowers may receive more favorable terms compared to traditional lenders due to lower overhead costs.

- Peer-to-peer lending offers a quicker and more accessible borrowing option for individuals or businesses.

Benefits of peer-to-peer lending for borrowers and investors

Peer-to-peer lending offers several benefits for both borrowers and investors.

- Borrowers may access funds at lower interest rates compared to traditional lenders.

- Investors have the potential to earn higher returns compared to traditional savings accounts or investments.

- Diversification of investment portfolios is possible through funding multiple loans.

Peer-to-peer Lending Platforms

Peer-to-peer lending platforms are online platforms that connect borrowers with lenders without the need for traditional financial institutions. These platforms offer an alternative way for individuals to borrow or invest money, cutting out the middleman.

Popular Peer-to-peer Lending Platforms

- LendingClub: One of the largest peer-to-peer lending platforms, offering personal loans, business loans, and patient financing.

- Prosper: Another well-known platform that provides personal loans with fixed rates and terms.

- Upstart: Focuses on personal loans and uses artificial intelligence to assess borrower creditworthiness.

Comparison of Features

- LendingClub offers a wider range of loan options compared to Prosper and Upstart.

- Upstart’s use of AI may result in faster loan approvals and potentially better interest rates for borrowers.

- Prosper has a straightforward application process and transparent fees.

Risks of Investing through Peer-to-peer Lending Platforms

- Default risk: Borrowers may fail to repay their loans, resulting in losses for investors.

- Lack of regulation: Peer-to-peer lending platforms are not as tightly regulated as traditional financial institutions, increasing the risk of fraud or misconduct.

- Market risk: Economic downturns or changes in interest rates can impact the performance of loans on these platforms.

Borrowing through Peer-to-peer Lending

Peer-to-peer lending offers borrowers an alternative way to secure loans outside traditional banking systems. The process involves connecting individual borrowers with individual lenders through online platforms, cutting out the middleman.

Process of Borrowing Money

- Create an account: Start by creating an account on a peer-to-peer lending platform and provide necessary information.

- Submit loan application: Fill out a loan application detailing the amount needed, purpose, and repayment terms.

- Review and approval: Lenders will review your application and decide whether to fund your loan based on risk assessment.

- Receive funds: Once your loan is funded, you will receive the funds directly to your bank account.

- Repay loan: Make monthly payments, including interest, as agreed upon with the lender.

Requirements for Borrowers

- Good credit score: A higher credit score increases your chances of securing a loan at favorable rates.

- Income verification: Lenders may require proof of income to ensure you can repay the loan.

- Debt-to-income ratio: A lower ratio indicates your ability to manage debt responsibly.

- Loan purpose: Some platforms may restrict loan purposes, so ensure your needs align with their policies.

Tips for Securing Loans Successfully

- Maintain a good credit score: Regularly check your credit report and work on improving your score.

- Provide accurate information: Ensure all details in your application are truthful and up-to-date.

- Opt for a realistic loan amount: Request an amount you can comfortably repay to avoid defaulting.

- Engage with lenders: Respond to inquiries promptly and provide any additional information they may require.

Investing in Peer-to-peer Lending

Investing in peer-to-peer lending involves individuals funding loans for borrowers through online platforms in exchange for potential returns. It provides an alternative investment opportunity compared to traditional methods like stocks or bonds.

Potential Returns and Risks for Investors

- Potential Returns: Investors can earn higher returns compared to savings accounts or CDs due to the interest earned on funded loans. The returns vary based on the platform, borrower’s creditworthiness, and loan terms.

- Risks: There are risks involved, including the potential for borrowers to default on loans, resulting in loss of investment. Economic downturns can also impact repayment rates, affecting returns.

- Regulatory Risks: Changes in regulations can impact the peer-to-peer lending industry, affecting the investment landscape and returns for investors.

Strategies for Diversifying Investments in Peer-to-peer Lending

- Diversification is key to managing risks in peer-to-peer lending. Investors can spread their investments across different loans, borrowers, and platforms to minimize the impact of defaults on their overall portfolio.

- Investing in loans with varying risk levels can help balance the portfolio and potentially increase overall returns. Platforms offering automated investing tools can assist in diversifying investments efficiently.

- Regularly monitoring the performance of investments, reinvesting returns, and adjusting investment strategies based on market conditions can help investors navigate the risks associated with peer-to-peer lending.