Importance of Financial Wellness Programs

Financial wellness programs are crucial for promoting the overall well-being of employees in the workplace. These programs help individuals manage their finances effectively, reduce stress related to money issues, and improve their overall quality of life.

Benefits of Financial Wellness Programs

- Increased employee productivity: When employees are not stressed about their finances, they can focus better on their work, leading to higher productivity levels.

- Improved employee retention: Providing financial wellness programs can help retain top talent as employees feel valued and supported by their organization.

- Reduced absenteeism: Financially stressed employees are more likely to take time off work due to health issues, but with financial wellness programs in place, absenteeism rates can decrease.

- Enhanced employer reputation: Companies that prioritize their employees’ financial wellness are viewed more positively by both current and potential employees, enhancing their reputation as an employer of choice.

Organizations with Successful Financial Wellness Programs

- Google: Google offers a wide range of financial wellness resources, including workshops, one-on-one counseling, and online tools to help employees manage their finances effectively.

- IBM: IBM’s financial wellness program focuses on educating employees about retirement planning, budgeting, and debt management, helping them achieve financial stability.

- Salesforce: Salesforce provides financial coaching sessions, webinars, and access to financial planning tools to support employees in achieving their financial goals.

Components of a Financial Wellness Program

Financial wellness programs typically consist of various key elements aimed at improving the overall financial health and well-being of individuals. These components often encompass education, tools, resources, and support to help individuals better manage their finances and make informed decisions.

Financial Education

Financial education is a fundamental component of any financial wellness program. This may include workshops, seminars, online courses, or one-on-one sessions that cover topics such as budgeting, saving, investing, debt management, and retirement planning.

Financial Counseling

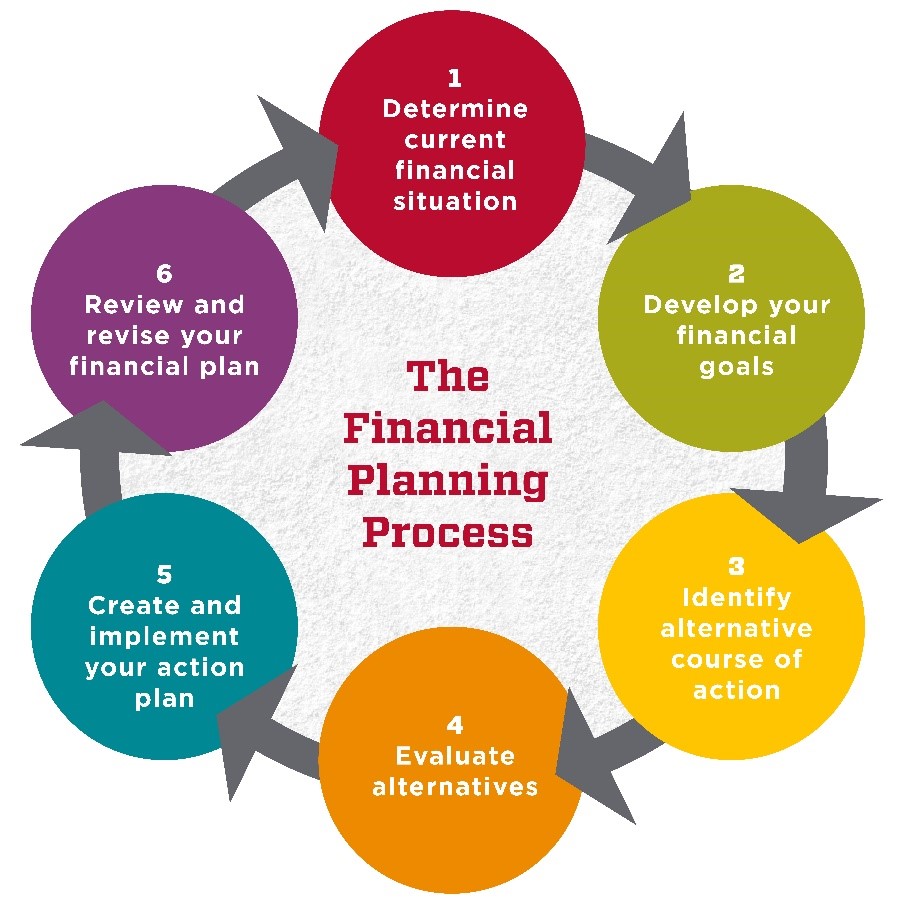

Financial counseling offers personalized guidance and support to individuals seeking help with their financial situation. This may involve working with a financial advisor or counselor to create a tailored financial plan, set financial goals, and address specific financial challenges.

Tools and Resources

Financial wellness programs often provide access to various tools and resources to help individuals track their expenses, monitor their financial progress, and make informed financial decisions. These may include budgeting apps, financial calculators, retirement planning tools, and resources for managing debt.

Employee Benefits

Some financial wellness programs are offered through employers as part of their employee benefits package. These programs may include employer-sponsored retirement plans, financial incentives for saving, access to financial advisors, and other resources to support employees’ financial well-being.

Wellness Challenges and Incentives

To encourage participation and engagement, some financial wellness programs incorporate wellness challenges and incentives. These may include rewards for achieving financial goals, participating in financial education sessions, or improving financial behaviors.

Best Practices for Implementing Financial Wellness Programs

Implementing financial wellness programs effectively is essential for the success of the initiative. Here are some best practices to consider:

Introducing Financial Wellness Programs to Employees

- Start by clearly communicating the purpose and benefits of the program to employees. Explain how it can help them improve their financial well-being.

- Provide personalized financial assessments or consultations to help employees understand their current financial situation and set realistic goals.

- Collaborate with leadership to gain their support and emphasize the importance of financial wellness for employee productivity and satisfaction.

Promoting Employee Engagement with Financial Wellness Initiatives

- Offer a variety of financial education resources, such as workshops, webinars, and online courses, to cater to different learning styles and preferences.

- Encourage participation through incentives or rewards for reaching financial goals or completing educational modules.

- Create a supportive and inclusive environment where employees feel comfortable discussing financial challenges and seeking help when needed.

Measuring the Success and Impact of Financial Wellness Programs

- Establish clear goals and key performance indicators (KPIs) to track the effectiveness of the program, such as increased savings rates or reduced financial stress levels.

- Regularly collect feedback from employees through surveys or focus groups to evaluate their satisfaction with the program and identify areas for improvement.

- Use data analytics tools to analyze the financial well-being of employees over time and assess the long-term impact of the program on their overall financial health.

Challenges and Solutions in Financial Wellness Programs

Implementing financial wellness programs can face various challenges that hinder their effectiveness. These challenges can range from lack of employee engagement to difficulties in measuring the impact of the programs. However, with the right strategies and solutions in place, these barriers can be overcome to ensure the success of financial wellness initiatives.

Common Challenges Faced in Financial Wellness Programs

- Lack of employee engagement and participation in financial wellness programs.

- Difficulty in measuring the impact and effectiveness of the programs.

- Resistance from employees due to privacy concerns or financial stress.

- Lack of support and buy-in from leadership in promoting financial wellness initiatives.

- Limited resources and budget constraints for implementing comprehensive programs.

Solutions to Address Barriers to Participation

- Offer personalized financial wellness solutions tailored to the needs of different employee demographics.

- Provide incentives or rewards for employees who actively engage in the programs.

- Enhance communication and transparency to build trust and address privacy concerns.

- Implement regular assessments and surveys to measure the impact of the programs and make necessary adjustments.

Role of Leadership in Overcoming Challenges

- Leadership plays a crucial role in promoting a culture of financial wellness within the organization.

- Executives and managers should actively participate in the programs to set an example for employees.

- Provide training and resources to help leaders effectively communicate the importance of financial wellness to their teams.

- Allocate adequate resources and support for financial wellness initiatives to demonstrate commitment from leadership.