Importance of Family Financial Planning

Family financial planning plays a crucial role in ensuring the well-being and stability of the entire household. By creating a comprehensive financial plan, families can set clear goals and work towards achieving them together.

Long-Term Goal Achievement

Financial planning allows families to Artikel long-term goals such as buying a house, saving for education, or planning for retirement. By creating a roadmap for financial success, families can track their progress and make adjustments as needed to stay on course.

- Setting aside funds for children’s education

- Building an emergency savings fund for unexpected expenses

- Planning for retirement to ensure a comfortable future

Involvement of Family Members

Involving all family members in financial planning discussions fosters a sense of unity and shared responsibility. It teaches valuable financial literacy skills to children and ensures that everyone is on the same page when it comes to budgeting, saving, and investing.

- Teaching children the importance of budgeting and saving from a young age

- Encouraging open communication about financial goals and priorities

- Promoting a collaborative approach to decision-making regarding financial matters

Setting Financial Goals as a Family

Setting financial goals as a family is crucial for ensuring financial stability and achieving long-term prosperity. By establishing realistic goals that align with the family’s values and priorities, everyone can work together towards a common objective. Let’s explore how families can set effective financial goals that cater to their unique circumstances.

Types of Financial Goals

When setting financial goals as a family, it’s essential to consider various aspects of your financial well-being. Some common types of financial goals families can consider include saving for education, retirement, emergencies, buying a home, starting a business, and more. Each of these goals plays a vital role in securing the family’s financial future.

- Saving for Education: Setting aside funds for your children’s education ensures they have access to quality learning opportunities without being burdened by student loans.

- Retirement Planning: Planning for retirement early on helps ensure financial security during your golden years, allowing you to enjoy a comfortable lifestyle.

- Emergency Fund: Building an emergency fund can help cover unexpected expenses like medical bills or car repairs without derailing your financial stability.

Short-term vs. Long-term Goals

It’s essential for families to set both short-term and long-term financial goals to maintain a balanced approach to financial planning.

- Short-term Goals: Short-term goals are typically achievable within a year or two and can include saving for a family vacation, paying off credit card debt, or building an emergency fund.

- Long-term Goals: Long-term goals, on the other hand, are focused on objectives that may take several years to accomplish, such as buying a home, funding children’s education, or retiring comfortably.

Budgeting and Saving Strategies for Families

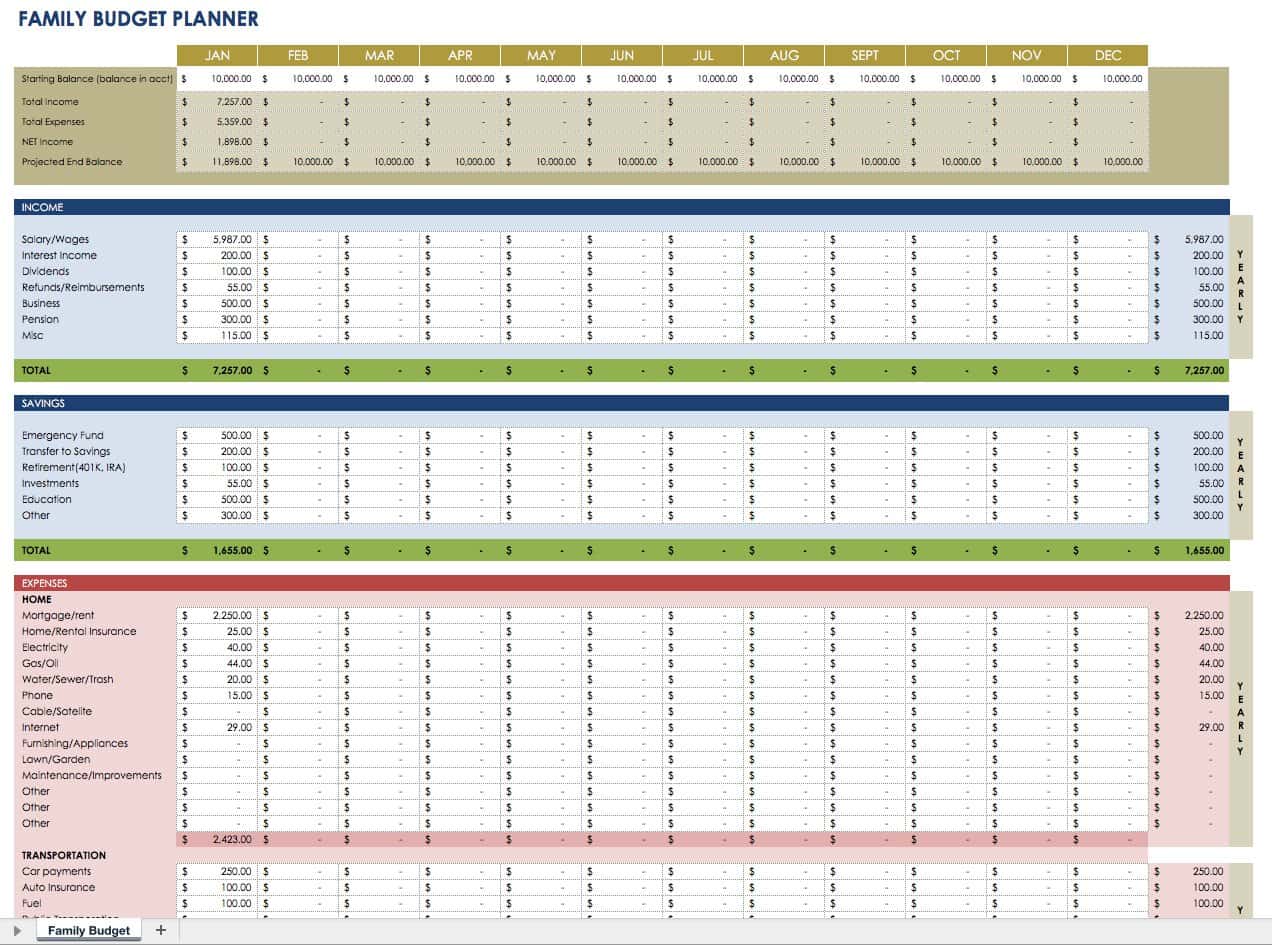

Effective budgeting and saving strategies are essential for families to ensure financial stability and security. By carefully managing expenses, tracking income, and implementing smart saving techniques, families can build a strong financial foundation for the future.

Budgeting Techniques for Families

- Start by creating a detailed budget that Artikels all sources of income and expenses.

- Track your spending and identify areas where you can cut back or reduce unnecessary expenses.

- Set realistic spending limits for different categories such as groceries, utilities, entertainment, and savings.

- Consider using budgeting apps or tools to help streamline the process and stay organized.

Saving Money as a Family

- Make saving a priority by setting aside a portion of your income each month for savings.

- Avoid impulse purchases and focus on needs rather than wants to reduce unnecessary spending.

- Look for ways to save on regular expenses such as shopping for deals, using coupons, or buying in bulk.

- Consider setting savings goals for specific purposes such as vacations, emergencies, or education.

Importance of an Emergency Fund

Creating an emergency fund is crucial for families to handle unexpected expenses or financial setbacks without going into debt. An emergency fund can provide a safety net during challenging times and prevent you from dipping into your savings or retirement accounts. Aim to save at least three to six months’ worth of living expenses in your emergency fund to ensure you are prepared for any unforeseen circumstances.

Investing for the Future

Investing for the future is a crucial step in securing financial stability for families. By putting money into various investment options, families can grow their wealth over time and achieve their long-term financial goals.

Types of Investments for Families

- Stocks: Investing in individual company stocks can provide high returns but also comes with high risk.

- Bonds: Bonds are considered safer investments compared to stocks, offering a fixed income over time.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities.

- Real Estate: Investing in real estate properties can generate rental income and appreciation in property value.

Diversifying your investment portfolio is essential to minimize risk and maximize returns.

How to Start Investing as a Family

- Educate yourself: Understand the basics of investing and different investment options available.

- Set investment goals: Define your financial objectives and the timeline for achieving them.

- Consult a financial advisor: Seek professional guidance to create a personalized investment plan based on your risk tolerance and financial situation.

- Start small: Begin with small investments and gradually increase your investment amount as you gain confidence and knowledge.

Estate Planning and Insurance

Estate planning and insurance play crucial roles in family financial planning by ensuring the protection and distribution of assets and finances in the event of unforeseen circumstances.

Importance of Estate Planning

Estate planning involves making decisions about how your assets will be managed and distributed after your passing. It helps minimize disputes among family members, reduces tax liabilities, and ensures that your loved ones are taken care of according to your wishes. Proper estate planning can provide peace of mind and financial security for your family’s future.

Role of Insurance in Family Financial Planning

Insurance is essential for protecting family finances and assets from unexpected events such as accidents, illnesses, or even death. Different types of insurance policies, such as life insurance, health insurance, property insurance, and disability insurance, provide financial security and stability in times of need. By having the right insurance coverage, families can mitigate financial risks and avoid potential financial hardships.

Types of Insurance Policies Families Should Consider

- Life Insurance: Provides a lump sum payment to beneficiaries upon the policyholder’s death, offering financial protection and support for loved ones.

- Health Insurance: Covers medical expenses, ensuring access to quality healthcare without incurring significant out-of-pocket costs.

- Property Insurance: Protects assets such as homes, cars, and personal belongings from damages or losses due to unforeseen events like fires, theft, or natural disasters.

- Disability Insurance: Offers income replacement in case of disability, enabling families to maintain their standard of living and meet financial obligations.