What Are Bonds?

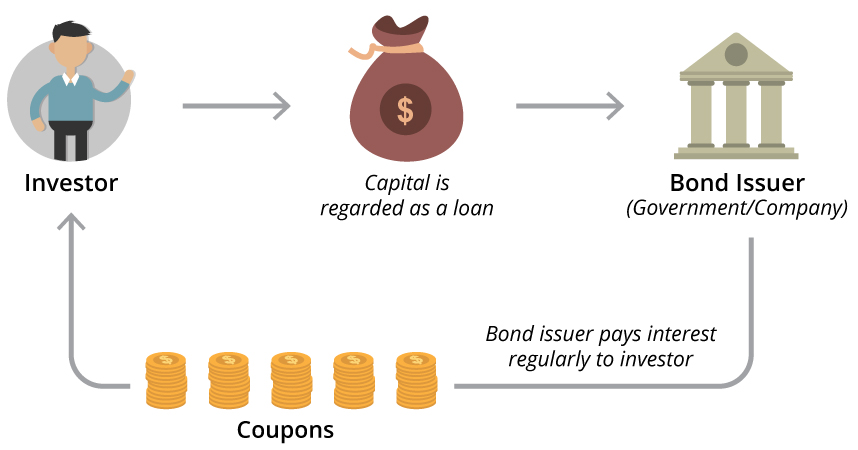

Bonds are a type of fixed-income investment where an investor loans money to an entity, typically a corporation or government, for a defined period of time at a predetermined interest rate.

Purpose of Bonds

Bonds serve as a way for companies and governments to raise capital by borrowing money from investors. They are a crucial component of the financial market, providing investors with a steady income stream through interest payments.

Key Characteristics of Bonds

- Maturity: This refers to the length of time until the bond issuer repays the principal amount to the bondholder. Bonds can have short-term (less than 5 years), medium-term (5 to 12 years), or long-term (over 12 years) maturity periods.

- Face Value: Also known as par value, this is the amount the bond issuer promises to repay the bondholder when the bond matures. It is typically $1,000 for corporate bonds and $100 for municipal bonds.

- Coupon Rate: The coupon rate is the interest rate that the bond issuer pays to the bondholder periodically, usually semi-annually. It is expressed as a percentage of the bond’s face value.

Types of Bonds

Government bonds, corporate bonds, municipal bonds, and high-yield bonds are some of the common types of bonds investors can choose from. Each type comes with its own set of risks and rewards, making it essential for investors to understand the differences before investing.

Government Bonds

Government bonds are considered one of the safest investments since they are backed by the government’s ability to tax its citizens. These bonds typically have lower interest rates but are considered low-risk investments.

Corporate Bonds

Corporate bonds are issued by corporations to raise capital. They offer higher interest rates compared to government bonds but also come with higher risk as they are dependent on the company’s financial health.

Municipal Bonds

Municipal bonds are issued by state and local governments to fund public projects. They are generally exempt from federal taxes, making them attractive to investors in higher tax brackets. However, they may carry some risk depending on the financial stability of the issuing municipality.

High-Yield Bonds

High-yield bonds, also known as junk bonds, offer higher interest rates to compensate for the increased risk of default. These bonds are issued by companies with lower credit ratings, making them more susceptible to economic downturns.

Secured vs. Unsecured Bonds

Secured bonds are backed by specific assets that the issuer pledges as collateral in case of default. In contrast, unsecured bonds, also known as debentures, are not backed by collateral and rely solely on the issuer’s creditworthiness. Secured bonds are generally considered less risky than unsecured bonds since there is collateral to recover in case of default.

How Bonds Work

When it comes to understanding how bonds work, it is essential to delve into the process of issuing bonds by governments or corporations, the relationship between bond prices and interest rates, as well as how bond yields are calculated and their significance to investors.

Issuing Bonds

- Governments or corporations issue bonds as a way to borrow money from investors.

- When an entity issues a bond, they are essentially entering into a contract with the bondholder, promising to repay the principal amount along with periodic interest payments.

Bond Prices and Interest Rates

- There is an inverse relationship between bond prices and interest rates. When interest rates rise, bond prices fall, and vice versa.

- Investors can buy and sell bonds in the secondary market, where bond prices fluctuate based on changes in interest rates.

Bond Yields

- Bond yields represent the return an investor can expect to receive from a bond.

- Yields are calculated by taking into account the bond’s coupon payments, its price, and its maturity date.

- For investors, bond yields provide insights into the potential returns and risks associated with investing in a particular bond.

Investing in Bonds

/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Investing in bonds can be a valuable addition to a diversified investment portfolio. Bonds can provide a steady stream of income or offer potential capital appreciation, depending on your investment goals and strategy.

Strategies for Investing in Bonds

When investing in bonds, consider the following strategies:

- Diversification: Spread your investments across different types of bonds to reduce risk.

- Duration: Match the duration of the bond to your investment time horizon.

- Yield: Consider the yield and credit quality of the bond to assess potential returns.

- Reinvestment: Reinvest interest payments to compound your returns over time.

Benefits and Risks of Including Bonds in an Investment Portfolio

Adding bonds to your investment portfolio can offer several benefits:

- Income Generation: Bonds can provide a predictable income stream through regular interest payments.

- Diversification: Bonds can help diversify your portfolio and reduce overall risk.

- Capital Preservation: Some bonds offer principal protection, providing a hedge against market volatility.

However, it’s important to consider the risks associated with bonds:

- Interest Rate Risk: Bond prices can fluctuate inversely with interest rates, impacting the value of your investment.

- Credit Risk: There’s a risk that the bond issuer may default on payments, leading to potential losses.

- Inflation Risk: Inflation can erode the purchasing power of fixed interest payments from bonds.

Impact of Bond Ratings on Investment Decisions

Bond ratings play a crucial role in guiding investment decisions:

- Bond Ratings: Agencies like Standard & Poor’s, Moody’s, and Fitch provide credit ratings that assess the creditworthiness of bond issuers.

- Investment Grade vs. Junk Bonds: Investment-grade bonds (BBB- or higher) are considered safer investments, while junk bonds (below BBB-) carry higher risk but offer higher yields.

- Impact on Returns: Higher-rated bonds may offer lower yields but provide more stability, while lower-rated bonds can offer higher returns but come with increased risk.