Importance of Credit Scores

Credit scores play a crucial role in the loan application process. Lenders use credit scores to assess the creditworthiness of borrowers and determine the risk involved in lending money to them. A higher credit score indicates a lower risk for the lender, while a lower credit score suggests a higher risk.

Credit Scores Impact on Interest Rates

One of the key ways credit scores influence loans is through their impact on interest rates. Borrowers with higher credit scores are likely to qualify for lower interest rates on loans, saving them money over the life of the loan. On the other hand, borrowers with lower credit scores may face higher interest rates, resulting in higher monthly payments and overall loan costs.

Role of Credit Scores in Loan Approval

Credit scores also play a significant role in determining whether a loan application is approved or rejected. Lenders use credit scores as a factor in their decision-making process, along with other financial information provided by the borrower. A high credit score can increase the chances of loan approval, while a low credit score may lead to rejection or approval with less favorable terms.

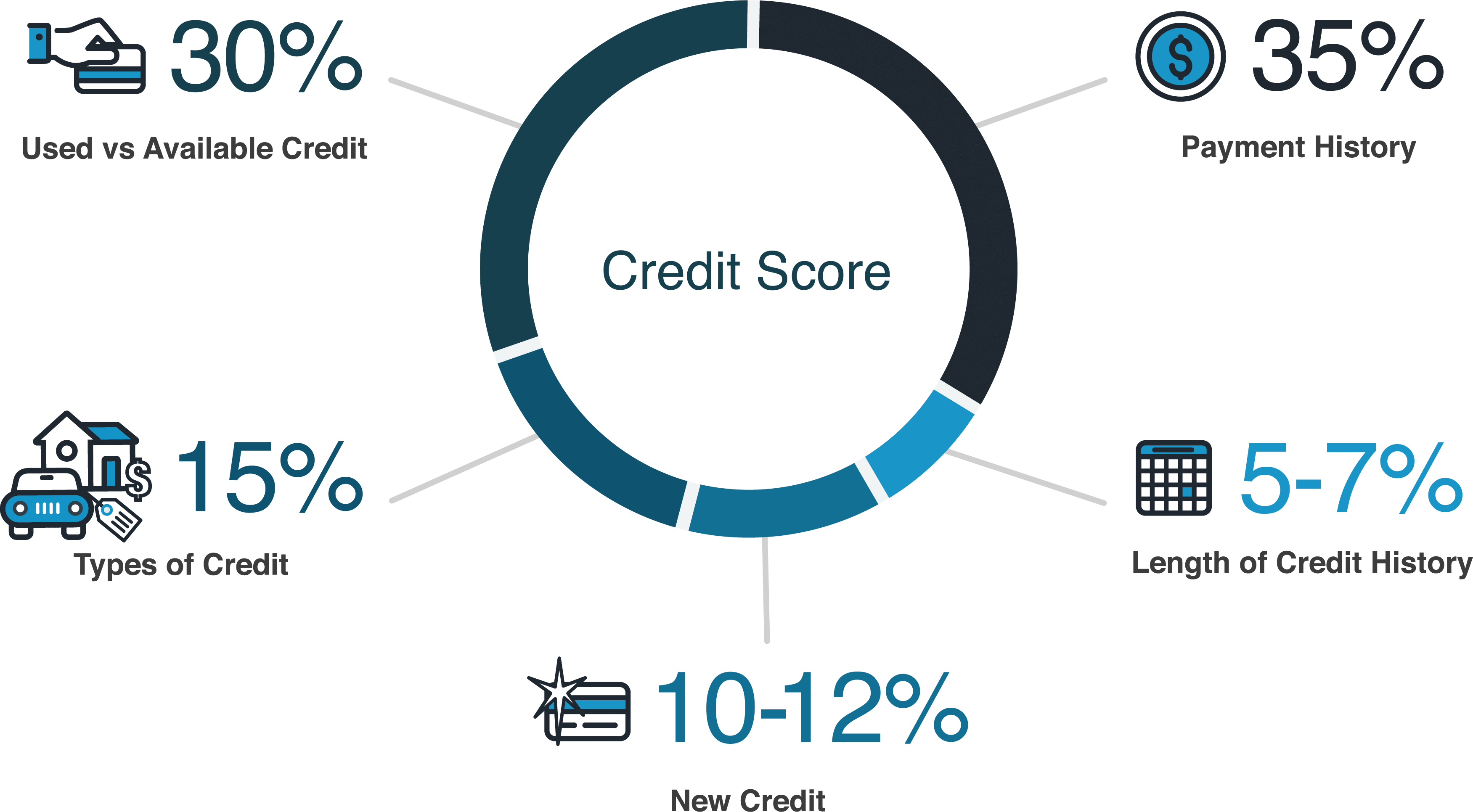

Factors Affecting Credit Scores

When it comes to credit scores, there are several key factors that can significantly influence an individual’s score. These factors play a crucial role in determining a person’s creditworthiness and ability to access loans and credit.

Payment History

One of the most important factors that affect credit scores is payment history. This includes how consistently a person makes their payments on time for credit cards, loans, and other debts. Late payments, defaults, or bankruptcies can have a negative impact on credit scores, while a history of timely payments can help improve and maintain a good credit score.

Credit Utilization

Credit utilization refers to the amount of available credit that a person is using at any given time. It is calculated by dividing the total outstanding balance by the total credit limit. High credit utilization ratios can indicate to lenders that a person may be overextended and have difficulty managing their debts, which can lower their credit score. It is generally recommended to keep credit utilization below 30% to maintain a healthy credit score.

Types of Loans Affected

When it comes to loans, credit scores can have a significant impact on the approval process and terms offered. Let’s explore which types of loans are most affected by credit scores and how they influence various loan approvals.

Mortgage Loans

Mortgage loans are one of the most significant financial commitments individuals make in their lifetime. Credit scores play a crucial role in determining eligibility for a mortgage loan and the interest rate offered. A higher credit score typically results in better terms, such as lower interest rates and smaller down payment requirements. On the other hand, a lower credit score may lead to higher interest rates, larger down payments, or even rejection of the loan application.

Personal Loans

Personal loans are unsecured loans that individuals can use for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Credit scores heavily influence the approval process and the interest rates offered for personal loans. Lenders assess the creditworthiness of applicants based on their credit scores, with higher scores leading to more favorable loan terms. For example, individuals with excellent credit scores may qualify for lower interest rates, while those with poor credit scores may face higher rates or even rejection.

Auto Loans

Auto loans are another type of loan where credit scores play a significant role. Lenders use credit scores to assess the risk of lending money to individuals seeking to purchase a vehicle. A higher credit score can result in lower interest rates and more favorable loan terms, while a lower credit score may lead to higher rates or difficulty in securing financing. Having a good credit score can make a substantial difference in the overall cost of financing a vehicle.

Strategies to Improve Credit Scores

Improving credit scores is essential for better financial opportunities. By following some key strategies, individuals can boost their credit scores, enhance their financial health, and qualify for better loan terms.

Monitor Credit Reports Regularly

It is crucial to monitor credit reports regularly to ensure accuracy and identify any errors that could be negatively affecting your credit score. By reviewing your credit report, you can spot any discrepancies or fraudulent activities and take necessary steps to rectify them.

Reduce Debts and Utilize Credit Wisely

One effective way to improve credit scores is to reduce debts and manage credit utilization wisely. Aim to keep credit card balances low and pay off debts on time to demonstrate responsible financial behavior. This can have a positive impact on your credit score over time.

Establish a Good Payment History

Consistently making on-time payments is key to improving credit scores. Late payments can significantly lower your credit score, so it’s important to prioritize timely payments on all your credit accounts, including loans, credit cards, and other bills.

Diversify Your Credit Mix

Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, can positively impact your credit score. This shows that you can manage different types of credit responsibly, which can improve your creditworthiness in the eyes of lenders.